Unveiling Flaws in the Financial System: Risks and Preparations

A Closer Look at the Article by Pamela Martens and Russ Martin

Introduction:

In this extensive analysis, we delve into an insightful article by investigative reporters Pamela Martens and Russ Martin from Wall Street on Parade. These journalists have established themselves as some of the best in the field, unearthing the inner workings of the Federal Reserve, the Treasury, and the big banks. Their meticulous scrutiny of these institutions allows for a comprehensive understanding of their activities. This article highlights their findings and sheds light on the alarming discrepancies and potential risks lurking within the financial system.

Examining the Banks and Their Troubles:

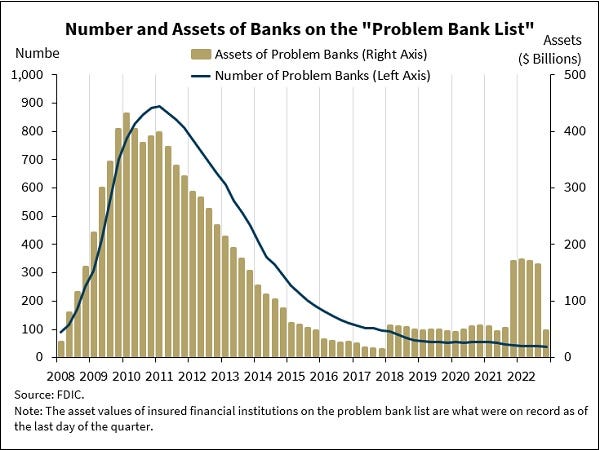

The article begins by discussing the banks listed on the FDIC's watchlist, comprising 39 institutions with combined assets of approximately $47.5 billion. However, the truly staggering revelation lies in the fact that the three banks that ultimately collapsed - Silicon Valley Signature, First Republic, and another unnamed bank - possessed a total asset value of $551 billion. This discrepancy is more than 11 and a half times the initial estimate, a colossal oversight by the FDIC.

A Looming Second Wave of Crisis:

As the article progresses, it becomes increasingly apparent that now is a critical time to prepare for significant upheavals in the financial landscape. While a temporary reprieve may have been granted, it is unlikely to last indefinitely. Digging deeper into the analysis, we discover that the market value of assets held by the U.S. banking system is a staggering $2.2 trillion lower than its book value suggests. This discrepancy arises from accounting practices related to loan portfolios and their secondary market values. Major banks such as JP Morgan, Bank of America, Citigroup, and Wells Fargo are implicated in this accounting disparity. To put this in perspective, the $2.2 trillion shortfall represents over 10% of the entire M2 currency supply in the United States.

The Significance of "Held to Maturity" Accounting:

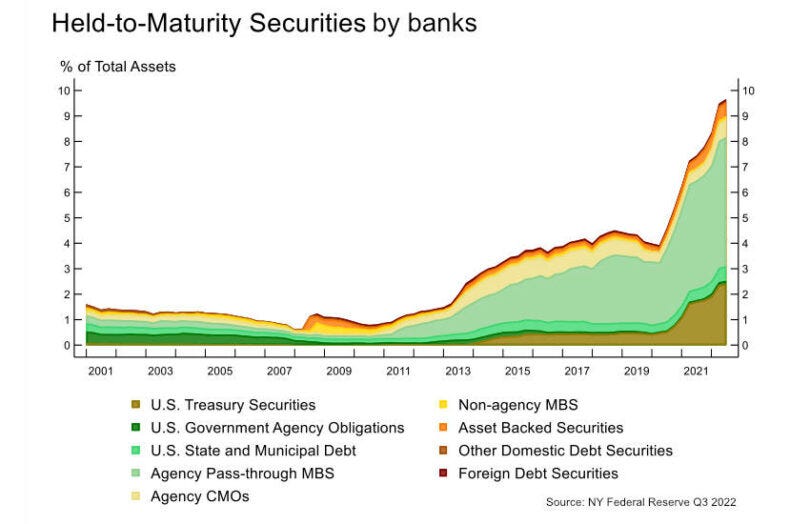

The article draws attention to the concept of "held to maturity" (HTM) accounting, which allows banks to maintain the value of loans on their books based on the assumption that borrowers will continue to make payments. This practice masks the plummeting worth of loans written at lower interest rates, as their secondary market values decline. In effect, the banks are permitted to hide these devalued assets until they reach maturity. This accounting strategy, referred to wittily as "hide till maturity," raises concerns about the validity and transparency of financial reporting. While not necessarily illegal, it exposes potential threats to the economy.

Implications for the Economy:

The massive scale of this semi-fraudulent accounting is cause for alarm. It represents a glaring misrepresentation of more than 10% of the U.S. currency supply. Such an immense error raises questions about the stability of the financial system and its impact on the broader economy. The article emphasizes the urgency of familiarizing oneself with these revelations and understanding that the current financial crisis may only be the beginning. A second wave of crisis looms, poised to have far-reaching consequences that surpass the initial shockwaves.

Uninsured Deposits and the FDIC's Role:

Towards the conclusion of the article, Martens and Martin reveal that the FDIC has confirmed the existence of $7.7 trillion in total uninsured deposits. These deposits fall outside the FDIC's protective coverage, presenting a significant vulnerability for depositors. This figure accounts for a substantial 37% of the U.S. currency supply, illustrating the magnitude of the potential risks faced by individuals and the broader financial system.

Preparing for the Future:

Given the intricate web of deception and risks outlined in the article, it is imperative to take proactive measures to protect oneself. The impending financial challenges necessitate thorough preparation to mitigate the potential negative impacts. While the current reprieve may provide a temporary respite, it is crucial to recognize that the underlying issues persist and may lead to a more severe crisis in the future.

It is advisable to consider several strategies to safeguard personal finances and investments. Firstly, diversifying one's portfolio by allocating assets across various classes can help reduce exposure to any single sector or institution. This approach spreads the risk and enhances the chances of preserving wealth during turbulent times.

Additionally, staying informed and educated about the financial system and its intricacies is paramount. Continuously monitoring market trends, economic indicators, and regulatory developments enables individuals to make well-informed decisions and adapt their strategies accordingly. Engaging in independent research, reading insightful articles, and seeking guidance from reputable financial advisors can provide valuable insights and support in navigating the complex financial landscape.

It is also prudent to consider alternative investment options that may offer stability and potential growth during uncertain times. Precious metals, such as gold and silver, have historically served as safe-haven assets during economic downturns. Their intrinsic value and limited supply make them attractive assets to preserve wealth and hedge against inflation.

Furthermore, maintaining a solid emergency fund is essential to weather unexpected financial storms. Setting aside a portion of income in a liquid and easily accessible account ensures a cushion to meet unforeseen expenses and withstand economic instability.

Lastly, fostering a conservative approach to borrowing and managing debt is crucial. Taking on excessive debt increases vulnerability to financial shocks and limits flexibility in times of crisis. Prioritizing debt reduction and maintaining a healthy credit score are integral parts of a robust financial plan.

In conclusion, the article by Pamela Martens and Russ Martin sheds light on the deep flaws and potential risks within the financial system. While the gravity of the situation may be daunting, it also presents an opportunity to proactively prepare for the challenges ahead. By diversifying investments, staying informed, exploring alternative assets, building emergency funds, and managing debt responsibly, individuals can fortify their financial position and navigate the uncertainties of the future with greater confidence.

Here is a link to the full article:

Thank you for reading! If you found this information valuable, please consider sharing it with others who might benefit from it. Don't forget to hit the like button to show your support. Your engagement helps us spread awareness and empower individuals in navigating the complex financial landscape. Together, we can build a more informed and prepared community.

Like, Subscribe, and Share to Spread the Word!

Subscribed

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.