URANIUM: URA ETF

Today we will look to a quick update about the markets and our favorite sectors, Uranium, and precious metals.

Well, as expected, the Uranium rally was only a fake-out, a little bit disappointing but what can you expect when a sector moves insanely fast in such a period of time, besides, that’s how thin and volatile this market is.

In my opinion, we could head to a lower low now that we weren’t unable to break through resistance and this precipitous pullback is hitting our holdings, fortunately, we had some profit-taking due to such big moves on the way up, now that it seems that we are heading lower, we can expect to start redeploying some capital after the dust settles.

GOLD

Undoubtedly, gold appears to be excessively overbought across almost all timeframes, and while we are impressed by its upward trajectory, it is now time to exercise caution. We recommend taking some profits and preparing for a possible abrupt and unforeseen decline, given that we have not yet surpassed the 2089 threshold and are likely to fail at our initial attempt.

Moreover, we observe negative divergences throughout the market, which leads me to doubt that the bullion banks will allow this rally to persist. If I were a bullion bank attempting to suppress the price of gold, I would aim to push it down from $2000, but given its tendency to rebound quickly, I would consider allowing it to spike dramatically before pulling the plug, catching everyone off guard and ushering in a bull trap.

SILVER

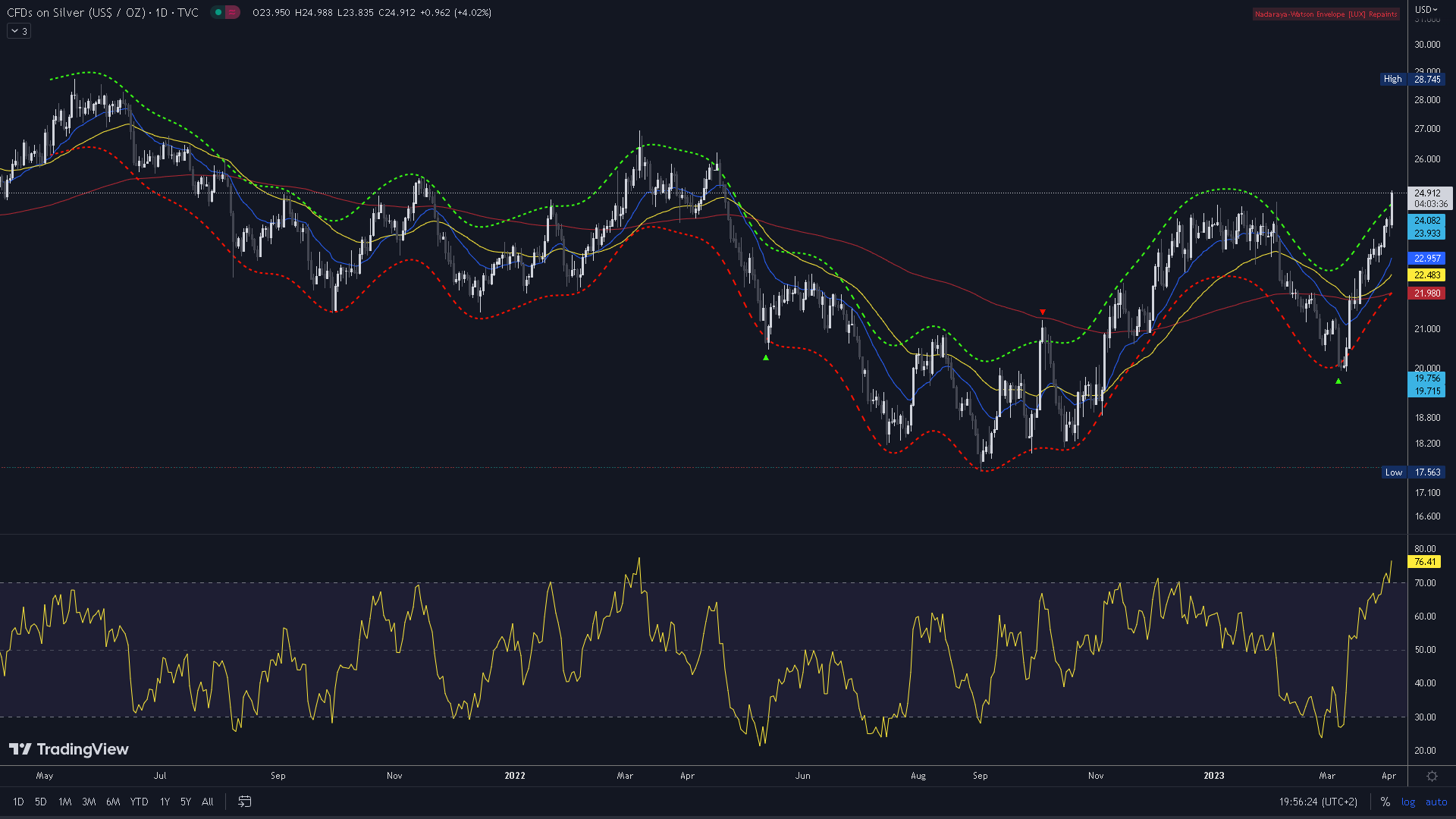

It is likely that the price of Silver may experience a sudden decline to around $21, where there is a strong support zone. Although the overall trend for Silver is positive, the market is currently overextended across all timeframes, and the Relative Strength Index (RSI) indicates that it is extremely overbought. As a result, a correction is necessary to bring the market back to more reasonable levels.

Despite these short-term concerns, Silver is still my favorite sector due to its strong fundamentals. In previous newsletters, we discussed in detail why Silver currently is in my opinion, the most undervalued asset in the world. If you are interested in learning more about this topic, you can follow the link provided to access our article.