Uranium Market Dynamics Updates

Navigating the Changing Landscape of the Global Uranium Industry

The global uranium market is experiencing a dynamic shift in recent times, driven by factors that are impacting both supply and demand. With uranium being a vital element in nuclear energy production, understanding these developments is crucial for both investors and those keen on the energy sector. This comprehensive update provides insights into the current state of the uranium market, revealing key developments and prospects for the future.

Introduction

The uranium market is witnessing an extraordinary transformation as it continues to play a pivotal role in the global energy landscape. In this era of shifting energy priorities and evolving environmental concerns, nuclear energy is once again in the spotlight, breathing new life into the uranium industry. This update delves into the nuances of the uranium market, highlighting crucial developments that investors and industry enthusiasts must grasp.

The State of the Market

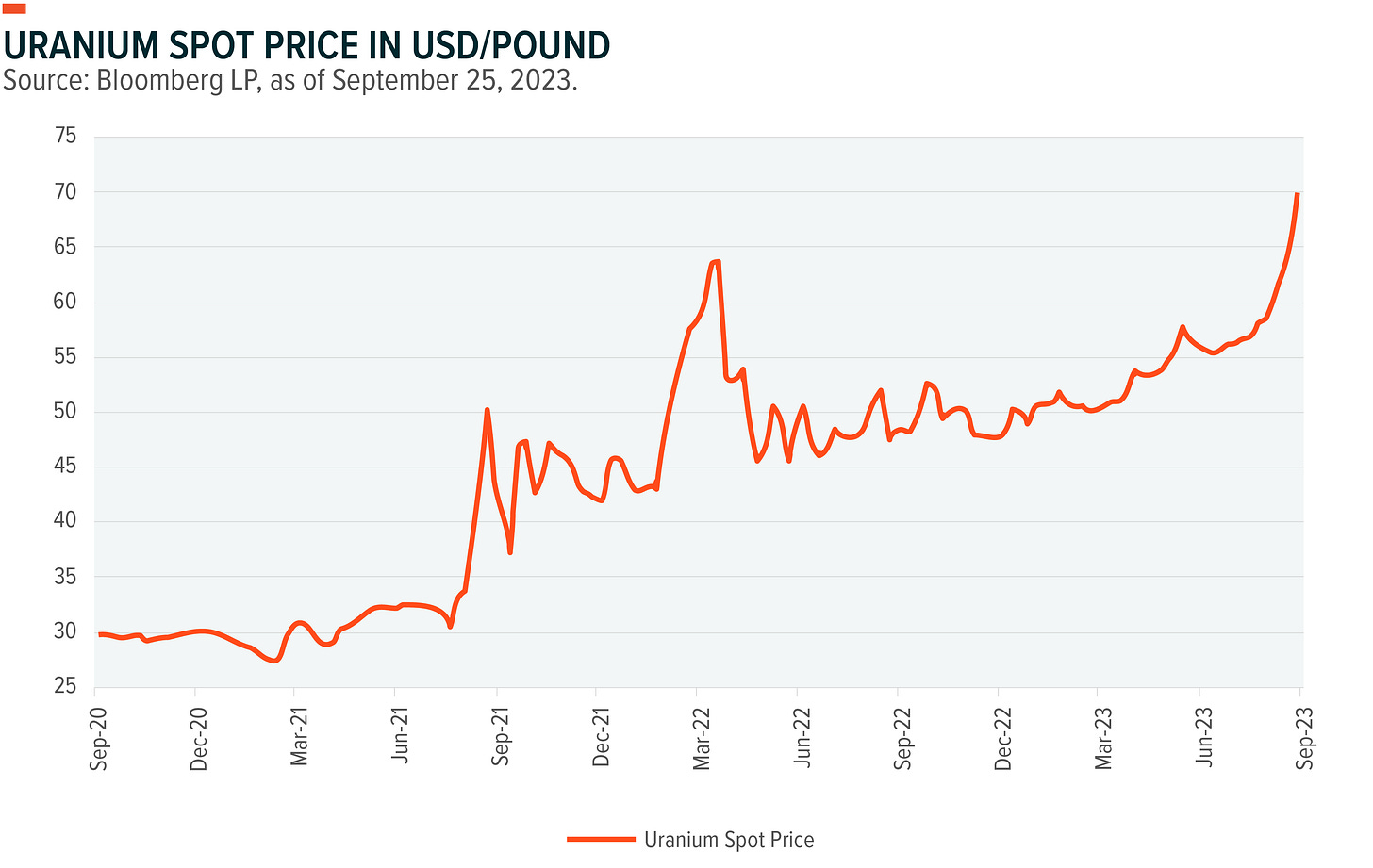

As of the latest reports, the uranium market has seen a notable surge, with prices climbing steadily over the past six to eight weeks. This uptrend is significant and is primarily attributed to robust trading volumes in the spot market. A remarkable 30% increase in uranium prices from mid-August to late September underscores the growing momentum. Importantly, this price surge has been achieved with limited influence from the financial market, indicating strong fundamental factors at play.

Supply and Demand Dynamics

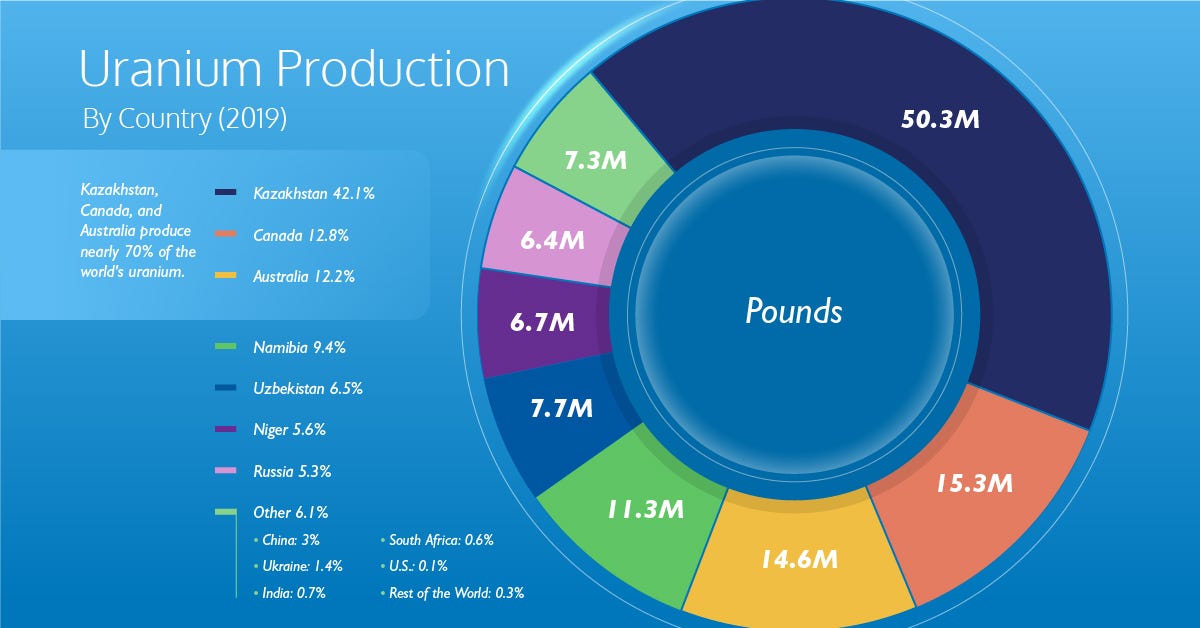

One of the pivotal aspects to consider in understanding the uranium market's trajectory is the interplay between supply and demand. Current assessments place the global uranium supply at just under 150 million pounds. While this figure constitutes approximately 85% of long-term contracting volume, experts anticipate that it may exceed this threshold. The presence of numerous on and off-market Requests for Proposals (RFPs) for long-term contracts adds further impetus to this upward trend.

The demand side of the equation is equally intriguing. China, one of the largest players in the uranium market, has transitioned from being a seller to a formidable buyer. Large contracts with Kazatomprom, exceeding 50% of the book value of the company, highlight China's unwavering demand for uranium. Additionally, nuclear utilities across the world are showing increased interest in long-term contracts, further amplifying the demand.

The Role of Inventories

While concerns about depleting inventories have emerged, it's essential to note that these inventories are held strategically by both utilities and nation-states. China, as the largest owner of uranium inventory, has shifted from selling to buying. Despite a noticeable decline in utility inventories, there's no indication of a panic situation on the horizon. Utilities are unlikely to compromise on fueling their reactors, which emphasizes the consistent and growing demand for uranium.

Regional Dynamics

Divergent regional dynamics are influencing the uranium market, most notably in Europe and the United States. European utilities, traditionally reliant on Russian supply, are gradually shifting away from this dependence. They are increasingly focusing on securing alternative supply sources, spurred by concerns about future sanctions or supply interruptions. The United States, though lagging somewhat behind, is expected to follow suit, with a surge in RFPs anticipated in the near future. This shift underscores the shifting global uranium supply landscape.

Production Updates

Key production sites like Cigar Lake and MacArthur River have faced reduced production due to ore storage issues and mill upgrades. However, efforts are underway to resolve these challenges, with a target production of approximately 18 million pounds for the next year.

Niger, on the other hand, has encountered operational hurdles. The inability to import necessary reagents for ore processing has forced a temporary shutdown of the mine, impacting uranium production and supply to France.

Kazakhstan, a prominent player in the uranium market, has announced plans to increase production. However, there is skepticism about their ability to achieve these ambitious targets. A significant portion of this production expansion is allocated to joint ventures, with a substantial quantity slated for export to Russia and France.

Conclusion

As we reflect on the state of the global uranium market, one thing becomes abundantly clear: the uranium industry is undergoing a profound transformation. Nuclear energy, once perceived as waning, is re-emerging as a significant player in the global energy sector. The demand for uranium is robust, driven by the resurgence of nuclear energy and underscored by consistent procurement by major players like China.

Supply dynamics, on the other hand, present a challenging picture. The global uranium supply chain lacks a relief valve, with no foreseeable exogenous event to mitigate the upward trajectory of prices. Uranium inventories, while strategic, are not expected to reach panic levels, as utilities prioritize reactor fueling.

In this shifting landscape, understanding the intricate dynamics of the uranium market is crucial. For investors and industry enthusiasts, staying informed and adapting to these changes is the key to navigating the evolving uranium market successfully. As we head towards the end of the year, the uranium market is poised for further developments, and it's a landscape worth monitoring closely.

Like, Subscribe, and Share to Spread the Word!

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thank you for joining us on this journey of understanding and change. Together, we can shape a brighter financial future for all.