"Warren Buffett's Massive Sell-Off: What It Means for the Market"

Market Trends and Warren Buffett’s Positioning

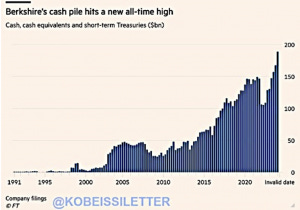

David Hunter began by discussing the psychology of market cycles and investor behavior. He noted that the market might experience a significant rally to numbers that could drive a rapid rush of investors attempting to reenter. "If this thing runs to the numbers I'm talking about, it's just the way psychology works," he remarked. Discussing Warren Buffett's decision to maintain a significant cash position of 30%, Hunter attributed this to Buffett's adherence to value investing principles. He emphasized that Buffett's strategy focuses on acquiring sizable positions in large companies, which have now become overvalued in his estimation. Hunter stated, "I think he's looking now and saying... particularly after the MAG S run... he just wants to see some value come back into the market."

Hunter pointed out that this isn't necessarily a broad market call from Buffett but rather a reflection of his investment philosophy. The discussion segued into the bond market, where Hunter shared his views on recent movements in bond yields. He was surprised by the recent rise above 4.5% on the U.S. 10-year Treasury yield, stating, "I thought that 4.50 was going to hold." However, he remained confident in his prediction of lower rates due to his expectation of a slowing economy and an eventual recession. He forecasted that a global bust would bring rates down to near zero before a long secular bear market in bonds emerges.

Long-Term Economic Outlook and Inflation Expectations

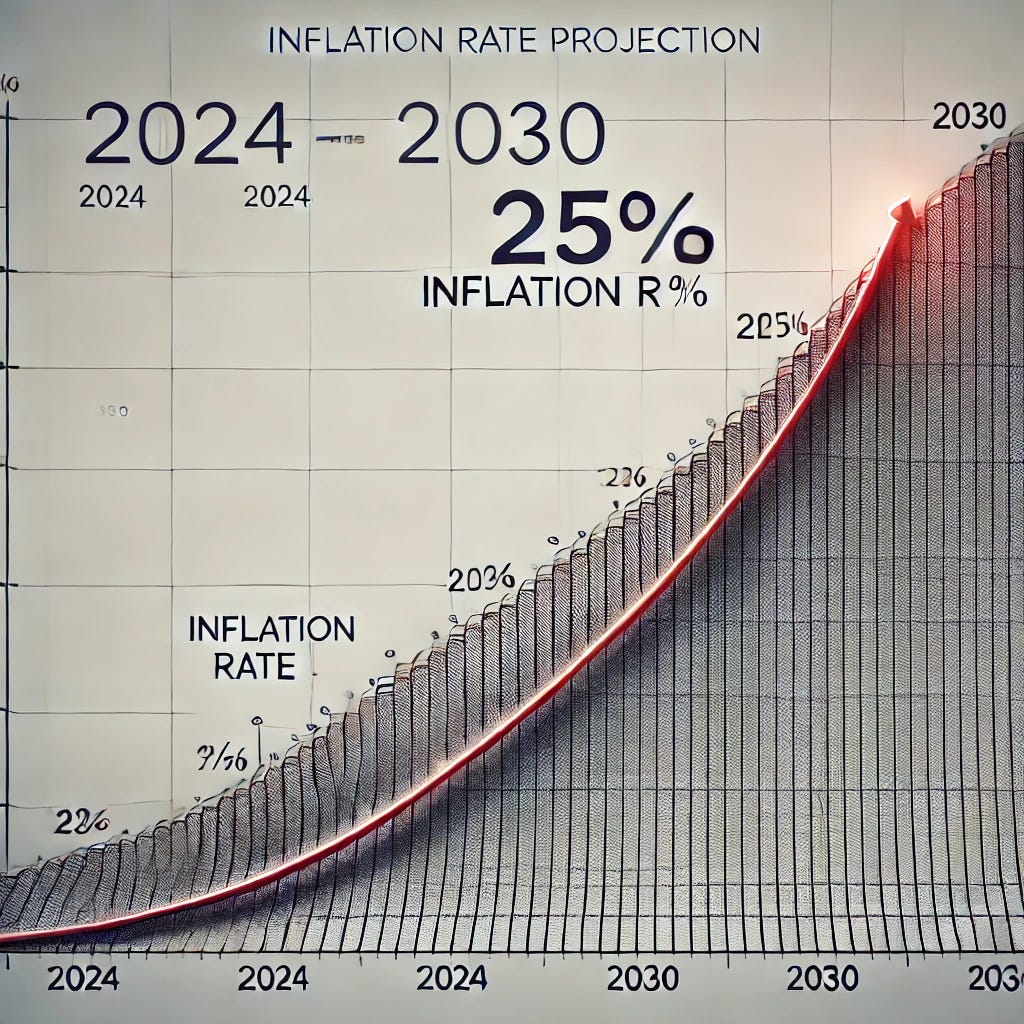

Hunter elaborated on his long-term expectations, predicting a peak inflation rate of 25% by the early 2030s. He warned of the devastating impact this would have on interest rates, which he expected to rise dramatically. "I would expect T-bills to be up over 20% and the long bond to be approaching 20%, somewhere between 15% and 20%," he forecasted. This would result in severe consequences for bondholders and those relying on duration in the next economic cycle.

Addressing the policy implications, Hunter suggested that the most prudent approach post-bust would involve rolling Treasury bills. He stated, "You can do 90-day or six-month Treasury bills and... you'll be reinvesting at ever-higher rates through the next cycle." However, he cautioned that sticking with duration investments, a strategy that worked during the bond bull market since the early 1980s, would be disastrous in the new environment. Hunter described the transition as the end of a 42-year secular bull market, emphasizing, "If that tops out next year, you're going to begin a secular bear market... that probably won't see highs again for decades."

Global Market Shifts and Investment Strategies

Hunter refrained from disclosing specifics about his investments but confirmed his active participation in the market. He explained that his investment philosophy aligns with his forecasts and that he is prepared for the significant changes he anticipates. "I walk that line of saying I'll forecast but I won't talk investments," he said. He advised investors to prepare for the upcoming shifts, emphasizing the importance of understanding one's risk tolerance.

He forecasted significant changes in market leadership during the next cycle and warned against relying on strategies that worked in the past. "We're in for major changes in the makeup of the market... what works, what doesn't work," he asserted. Discussing the broader implications of the current cycle, Hunter stressed the importance of adopting a contrarian approach, as he personally prefers to remain outside the crowd.

Bitcoin and Cryptocurrency Perspectives

Hunter admitted to not closely following Bitcoin and cryptocurrencies, explaining his choice to focus on markets with greater macroeconomic significance. He stated, "To this point, it does not have macro significance." Despite acknowledging the speculative momentum behind Bitcoin's rise, he expressed concerns about its "hype nature" and the risks associated with its steep ascent. "Anybody that wants to tell me it's up here on fundamentals... it's up here simply because momentum begets momentum," he commented.

While acknowledging that recent developments, such as SEC approvals for crypto funds, have driven demand, Hunter cautioned against overexposure to Bitcoin. He remarked, "I would be nervous if I were invested in crypto right now," warning of the potential for a sharp and fast pullback due to the steepness of its recent price increases.

Geopolitical Risks and Long-Term Challenges

On geopolitical risks, Hunter observed that markets have already discounted the ongoing Ukraine conflict and downplayed the likelihood of further escalation. He expressed optimism about potential de-escalation under a new U.S. administration, particularly regarding Ukraine and the Middle East. "With Trump coming in, I think it's more likely we get some sort of de-escalation there," he predicted.

However, Hunter did not discount the potential for longer-term instability and inflationary pressures arising from geopolitical tensions. He anticipated challenges stemming from reshoring efforts, tariff battles, and economic struggles in Europe. Looking further into the decade, he foresaw systemic financial collapse due to unsustainable debt levels. "How do we service our debt at 15%? We can't. There's no equation that works," he emphasized. Hunter projected dire scenarios, including "50% plus unemployment" and the collapse of welfare and social systems in the U.S.

Concluding Thoughts and Final Warnings

Hunter closed the interview by emphasizing the importance of understanding market psychology and avoiding herd mentality. He warned that the crowd tends to get drawn in at market tops, making it crucial for investors to know their risk tolerance and act accordingly. "Most people, whether they know it or not, are going to get drawn in with the crowd," he cautioned.

Encouraging a contrarian approach, Hunter expressed his contentment with standing apart from popular narratives. "I'm happy when nobody agrees with me," he said. He reiterated the importance of preparing for the significant changes ahead and maintaining a long-term perspective.

Hunter concluded by providing details on where to follow his insights and analysis, including his Twitter handle (@DaveHContrarian) and his subscription-based quarterly macro letter.

A Note of Thanks and How You Can Support Us

Thank you for taking the time to read this article and dive into the insightful discussion between David Hunter and Danny from CapitalCosm Expert Interviews. We’re dedicated to bringing you valuable perspectives and in-depth analysis from leading experts, but we can’t do it without your help.

If you found this article helpful or thought-provoking, we’d be incredibly grateful if you could show your support. Here are a few simple ways to help us continue our work:

Subscribe: Don’t miss out on our future interviews and articles. Hit that subscribe button to stay updated!

Share: Found this content valuable? Share it with friends, family, or colleagues who might benefit from these insights.

Like: A simple like goes a long way in helping us reach more readers and viewers, it takes just a second but makes a big difference.

Donate: If you’d like to support us monetarily, consider donating to help us keep producing high-quality content. Contributions allow us to cover more topics, expand our reach, and bring you even more in-depth discussions.

Your engagement means the world to us. Every subscription, share, like, or donation makes it possible for us to continue delivering content that matters. Thank you for being part of our journey, and we look forward to sharing more expert insights with you in the future!