Like, Subscribe, and Share to Spread the Word!

If you found this analysis informative and eye-opening, we invite you to like, subscribe, and share this video to help us spread the word. Together, we can build a community of Financial Anarchy advocates who are dedicated to promoting financial literacy and advocating for sound monetary policies. By amplifying our message, we can empower individuals to take control of their financial well-being and contribute to a more equitable and sustainable future.

Support Our Work with a Bitcoin Donation

We also offer the opportunity to support our work and help us continue building the Financial Anarchy community. If you would like to make a contribution, we gratefully accept donations in Bitcoin. Your support will enable us to create more educational content, engage in meaningful activism, and further our mission of challenging the status quo. To donate, please use the following Bitcoin address:

1EkmtWDYzuhkiv3iYozKVnZFxsQxDetnfH

Thanks for reading Financial Anarchy! Subscribe for free to receive new posts and support my work.

In this awe-inspiring and flawlessly beautiful universe, it's remarkable how we, as individuals, manage to navigate the coexistence of profound pain and boundless joy.

This delicate balance is fueled by our deep love for the divine and our unwavering admiration for the concepts of Risk and Silver. It's almost as if we find ourselves situated on parallel planes, akin to the surreal events of the Flash Crash of 2020 when delving into the realm of Silver mining.

Behold, the First Majestic - AG.

Allow me to emphasize that my intention here is not to voice a complaint but rather to offer a keen observation. Even as we stand at this juncture, surrounded by a surplus of printed currency, Silver boasts a higher valuation compared to the tumultuous events of the March 2020 crash. Yet, it perplexingly appears that most silver mining companies are currently trading at bewilderingly low valuations.

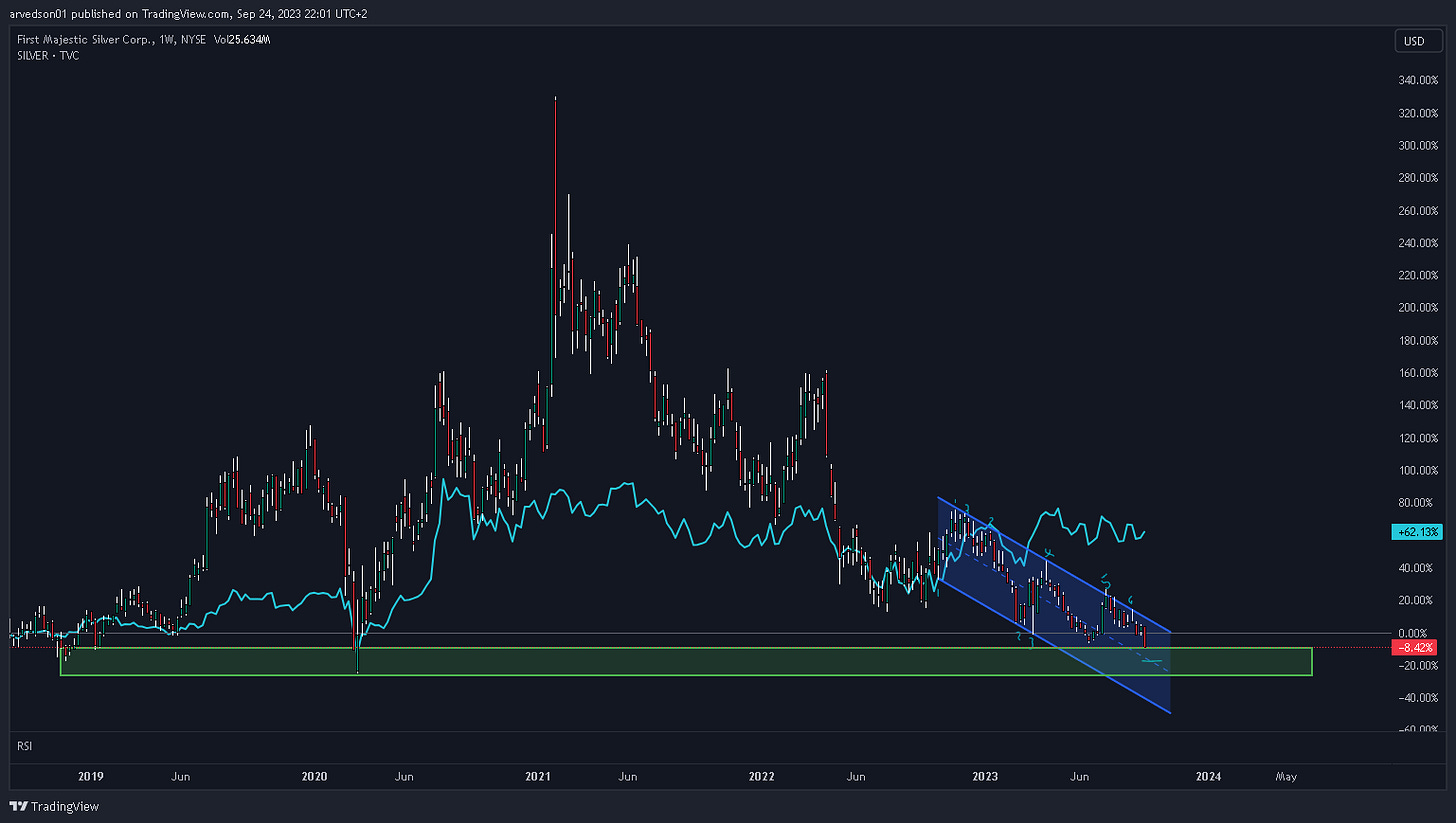

Here is a comparison of the percentage change between Fisrts Majestic and Silver:

The graph distinctly illustrates the performance dynamics between Silver, represented by the blue line, and AG stock. An intriguing departure from the norm is evident, as for the better part of the past four years, AG stock consistently outpaced Silver. However, in the current scenario, there is a notable role reversal, with Silver emerging as the frontrunner. This shift is particularly noteworthy because Silver is not only holding its own against a robust dollar but also displaying resilience against the market manipulative forces that have historically influenced its trajectory.

Despite the prevailing circumstances, my belief remains steadfast that we may still experience a downward trajectory from this point, if only for a brief interval. My conviction in this matter stems from the insights gleaned from the following chart:

Our trading activity has been confined within the confines of a descending channel, and we have valiantly attempted to breach its barriers on six separate occasions, only to be met with resolute resistance each time. In the wake of this sixth rejection, it seems increasingly likely that we are on the verge of revisiting the midpoint of this channel.

The forthcoming objective is to target a price point in the vicinity of 4.50, thereby establishing yet another lower low. This critical move is poised to serve as the launch pad for our impending seventh endeavor to break free from the constraints of this channel.

However, should the price exhibit a decline beneath the channel's midpoint, it is prudent to consider that our next destination could potentially plummet to as low as 2.90.

Conclusion

In conclusion, it becomes evident that in our endeavors to speculate in the silver market, we must adopt a longer-term perspective. The fundamentals that underpin this precious metal will, over time, rise above the shadow of manipulation that has persisted for nearly a century.

Paradoxically, the more concerted efforts are made to manipulate the price of silver, the greater the inherent risk for those attempting to control it. This constant manipulation only serves to build up potential pressure, which could eventually lead to a loss of control over the market.

During this period characterized by stagflation and erratic market behavior, it is essential to exercise patience. Despite the market's seeming irrationality, these are often the preludes to significant shifts. Stagflationary periods historically lead to higher commodity prices, and within this landscape, there's a hopeful prospect that silver will emerge as the standout performer among them all.

In the end, while manipulation may have a temporary impact, the enduring strength of silver's fundamentals and the broader economic forces at play suggest that, over the long haul, it is the fundamentals that will ultimately prevail.