What Happens When Banks Face Financial Collapse?

Understanding the Consequences for Depositors, Shareholders, and the Financial System

Banks are required by regulators to maintain a certain level of capital adequacy and risk management practices to ensure that they can withstand economic downturns and other financial shocks. While there is no way to guarantee that banks will not collapse, the financial system has many safeguards in place to prevent such an occurrence.

In the event that a bank does face financial difficulties, there are mechanisms such as government bailouts, mergers, and acquisitions that can be used to support its recovery or ensure the continuity of its services.

That being said, it is important to stay informed about the banking industry and to make informed decisions regarding your financial affairs. If you have concerns about the stability of a bank, it is advisable to seek the advice of a qualified financial professional.

A bail-out is a financial rescue operation in which a government or other external entity provides financial support to a struggling bank in order to prevent its collapse. This usually involves injecting funds into the bank, or buying some of its assets, in order to keep it afloat. Bail-outs are typically used as a last resort and can be very expensive for the government or taxpayers who foot the bill.

On the other hand, a bail-in is a mechanism that allows a struggling bank to be recapitalized by converting some of its debt into equity, effectively making its creditors the new shareholders. This can be done through a variety of methods, such as writing off or converting some of the bank's bonds or other debt instruments. In a bail-in, the bank's shareholders and creditors are the ones who bear the costs of the restructuring, rather than the government or taxpayers.

The key difference between a bail-in and a bail-out is who bears the costs of a bank's financial troubles. In a bail-out, the government or taxpayers are on the hook for the costs, while in a bail-in, the bank's creditors and shareholders are the ones who take the hit. Bail-ins are seen as a way to discourage risky behavior by banks since they make it clear that creditors and shareholders will be held responsible for the bank's losses.

According to financial experts, when a bank is facing financial collapse, it is a sign that it is unable to meet its financial obligations, which can lead to a cascade of defaults across the financial system. As Professor Richard S. Grossman, an economics professor at Wesleyan University, explains, "When banks don't have enough money to pay their obligations, they can default, and that default can spread to other banks and financial institutions, creating a systemic risk."

In such a scenario, the government or regulators may step in to prevent a wider economic collapse. As explained by Professor Anat Admati of Stanford University, "The government or the central bank will try to stabilize the situation by providing liquidity or by taking over the failing bank."

However, it is important to note that such interventions may come with consequences for creditors and shareholders of the failing bank. As Admati explains, "When the government intervenes, it may have to take control of the bank or force a merger with a stronger bank, which can result in losses for the shareholders and creditors."

In extreme cases, the government or regulators may seize or freeze funds in order to protect depositors and maintain financial stability. This can be done through a legal process and with proper authorization. As explained by Professor Gerard Caprio of Williams College, "The government can take control of the bank, liquidate it, or seize assets to protect depositors and prevent contagion."

It is important to note that such extreme measures are typically only taken as a last resort and that the financial system has many safeguards in place to prevent such an occurrence. As Caprio explains, "Banks are required to maintain a certain level of capital adequacy and risk management practices to ensure that they can withstand economic downturns and other financial shocks."

Ultimately, the stability of the banking system depends on a complex interplay of factors, including economic conditions, government policies, and the performance of the banking industry itself. It is advisable to stay informed about the stability of your bank and to take steps to protect your financial assets, such as diversifying your investments and regularly reviewing your financial plans with a qualified professional.

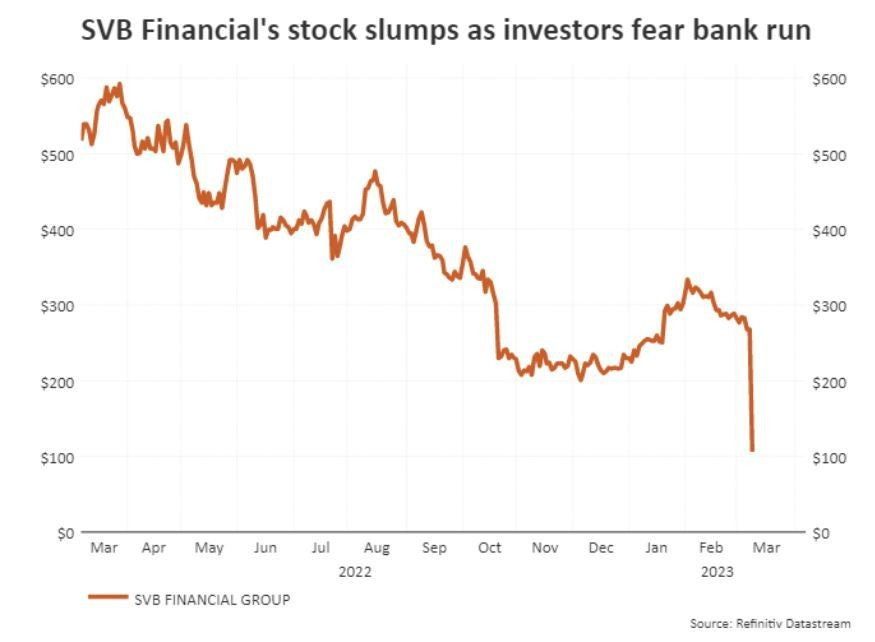

The previous topic of banks facing financial collapse is closely related to the concept of a global bank run. A bank run occurs when a large number of depositors withdraw their money from a bank or financial institution, typically due to concerns about its stability or solvency.

A global bank run refers to a scenario in which a bank run occurs on a large scale across multiple countries and regions, potentially leading to a widespread financial crisis. Such a scenario could be triggered by a number of factors, such as a sudden economic downturn, a major financial scandal, or a loss of confidence in the banking system as a whole.

If a global bank run were to occur, it could have serious consequences for depositors, shareholders, and the financial system as a whole. As we have seen in past financial crises, such as the 2008 global financial crisis, bank failures, and defaults can have a ripple effect across the financial system, potentially leading to widespread economic downturns and even recessions.

The consequences of governments and central banks taking measures to stabilize the financial system and prevent a wider economic collapse can vary depending on the specific measures taken and the context in which they are implemented.

Providing emergency funding and implementing temporary deposit insurance schemes can help to reassure depositors and prevent bank runs, which can be an effective way to stabilize the financial system in the short term. However, these measures can also have unintended consequences, such as creating moral hazard by encouraging banks to take on excessive risk knowing that they will be bailed out in the event of a crisis.

Similarly, seizing depositors’ and shareholders’ accounts can be an effective way to protect depositors and prevent contagion in the event of a systemic crisis, but it can also lead to significant losses for those affected. This can undermine confidence in the banking system and erode public trust in government and regulatory institutions.

Furthermore, the use of such extreme measures can also have broader economic and social consequences, such as exacerbating income inequality, increasing unemployment, and reducing economic growth. This can create political instability and social unrest, which can further undermine the stability of the financial system.

In the event of a financial crisis or bank collapse, creditors can take steps to protect themselves and minimize their losses. One important strategy is diversification, which involves spreading investments across different asset classes and geographic regions in order to reduce overall risk exposure.

Some assets that may be considered as part of a diversified portfolio include precious metals such as gold and silver, which are often seen as a safe haven asset during times of economic uncertainty. Real estate and farmland can also provide a hedge against inflation and other economic risks, as they can generate income and retain value over the long term.

Another strategy for protecting against financial risk is to maintain a conservative allocation of assets, with a focus on low-risk investments such as government bonds or cash reserves. This can help to ensure that a portion of the portfolio is protected in the event of a market downturn or other unexpected events.

It is also important for creditors to stay informed and aware of potential risks and vulnerabilities in the financial system. This may involve monitoring market trends and economic indicators, as well as staying up-to-date on regulatory developments and changes in government policies that could affect financial stability.

In addition, creditors may consider working with a financial advisor or investment professional who can provide guidance and support in developing a personalized risk management strategy. This can help to ensure that the portfolio is well-balanced and aligned with the individual's financial goals and risk tolerance.

Ultimately, protecting against financial risk requires a combination of prudent risk management practices, diversification, and a long-term perspective. By taking proactive steps to mitigate risk and stay informed, creditors can help to safeguard their financial well-being and minimize the impact of a financial crisis or bank collapse.

Thank you for taking the time to read the research. I hope that the information provided was helpful and informative.

If you found this Newsletter useful, I would encourage you to follow and like our page for more content on finance, economics, and current events. Additionally, feel free to leave a comment with any questions or feedback you may have - we value your input and strive to provide the most accurate and relevant information possible.

Lastly, if you think others would benefit from this information, please consider sharing it with your friends, family, or colleagues. We appreciate your support and look forward to continuing to provide valuable insights and analysis.