What’s Really Happening to Uranium?

Market Shifts, Geopolitics, and Price Predictions Explained

Insights from Justin Huhn of Uranium Insider

In a recent discussion with Steve Barton on the "In It to Win It" YouTube channel, uranium expert Justin Huhn of Uranium Insider delved into the current state and future prospects of the uranium market. This article provides a detailed analysis, breaking down key topics discussed in the interview, from supply-demand dynamics to geopolitical influences, and offers strategic insights for investors.

Understanding the Uranium Supply-Demand Imbalance

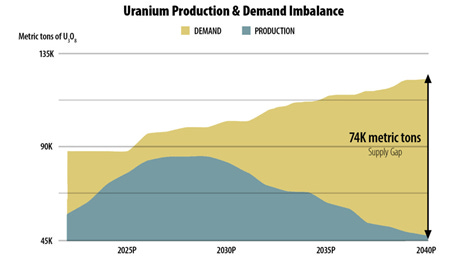

One of the central themes of the interview revolves around the imbalance between uranium supply and demand. While the global push for cleaner energy sources is driving up demand for nuclear power, uranium production has struggled to keep pace.

Rising Demand: As countries strive to meet climate goals, nuclear power is gaining prominence due to its low-carbon nature. This has led to a surge in uranium demand, with countries like China and India aggressively expanding their nuclear fleets.

Supply Constraints: Uranium production, however, has faced significant challenges. Many mines are operating below capacity, and ramping up production requires substantial time and investment. As a result, supply struggles to meet growing demand.

The supply-demand imbalance is a key driver of price inflation in the uranium market. With demand increasing and supply remaining stagnant, the market faces pressure to adjust. This imbalance presents a lucrative opportunity for investors, but it also underscores the risk of volatility, especially if supply disruptions occur.

Geopolitical Factors: Russia and China’s Role in Uranium Markets

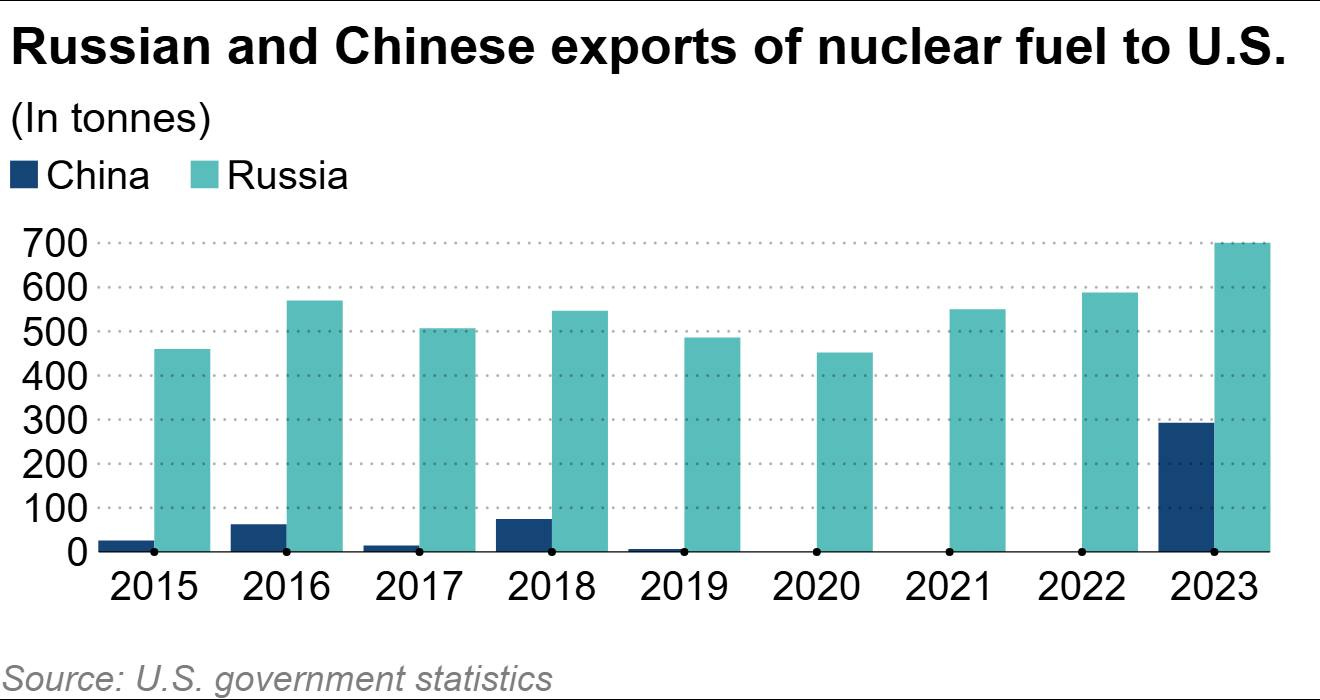

Geopolitics play a crucial role in shaping the uranium market, with Russia and China being two dominant forces. Huhn pointed out how both countries influence the market in different ways.

Russia's Influence: Russia controls a significant portion of the uranium enrichment process, which is essential for the functioning of nuclear reactors. Huhn explains that Russia’s dominance in this space makes it a potential bottleneck in the global uranium supply chain.

China’s Expanding Nuclear Program: China's aggressive nuclear expansion is increasing its demand for uranium. "China’s growing nuclear program is one of the major drivers of uranium demand for the next decade," Huhn notes.

These geopolitical factors introduce a level of uncertainty into the uranium market. While China’s nuclear expansion will continue to drive up uranium demand, Russia’s position as a critical player in uranium enrichment creates a vulnerability. Political or economic shifts involving these countries could have far-reaching consequences for uranium supply and prices.

The Impact of Germany's Nuclear Policy Shift

Germany’s decision to halt the decommissioning of its nuclear plants could have significant implications for uranium demand. After years of reducing its nuclear capacity, the country is considering reversing some of its previous policies.

Possible Reactor Restarts: Huhn discusses how Germany could potentially restart three reactors that were closed last year, as they are not in advanced stages of decommissioning. This would create immediate demand for uranium fuel.

Further Reactor Potential: Beyond the three reactors, Huhn speculates that Germany could restart up to six additional reactors, further increasing demand for uranium.

Germany’s shift in nuclear policy could add substantial demand for uranium, especially in the near term. If Germany restarts several reactors, it would increase competition for already limited uranium resources. This decision is especially notable as it comes at a time when many countries are reconsidering their stance on nuclear energy.

The Role of Underfeeding and Re-enrichment in the Uranium Market

A unique aspect of the uranium market is the practice of underfeeding and re-enrichment. Huhn explained how these processes impact uranium supply and market dynamics.

Underfeeding: Underfeeding occurs when enrichment plants use less uranium than contractually required, creating surplus feedstock that can be sold as a secondary supply.

Re-enrichment of Tails: Re-enriching uranium “tails” (depleted uranium) is another source of secondary supply. While re-enrichment has historically been common, Huhn points out that Western nations no longer engage in re-enrichment, leaving Russia as the primary source.

Underfeeding and re-enrichment are both methods used to supplement uranium supply when excess capacity exists. However, these practices are becoming less prevalent, particularly in the West. As uranium demand grows and excess enrichment capacity decreases, these secondary sources of supply are likely to dwindle, tightening the market further.

The Long-Term Outlook: How High Will Uranium Prices Go?

The uranium market’s future pricing trajectory is a topic of significant interest to investors. Huhn shared his thoughts on how uranium prices might evolve over the next decade.

Price Pressure: With supply remaining constrained and demand rising, Huhn predicts that uranium prices will continue to rise. "The market is in a supply deficit, and this will continue for the foreseeable future," he states.

Strategic Price Hikes: As the demand for uranium increases, particularly from newly restarting reactors and countries ramping up their nuclear programs, the pressure on supply is expected to push prices higher.

The supply-demand imbalance will likely be the dominant force driving uranium prices upward. However, the pace of price increases will depend on how quickly supply chains can adjust to rising demand. For investors, understanding the broader supply dynamics will be crucial to predicting price movements and making informed decisions.

Investor Strategy

Given the volatility of the uranium market, Huhn offered advice to investors looking to navigate its fluctuations.

Long-Term Focus: Huhn emphasizes the importance of a long-term view. The uranium market has wild price swings, but understanding the market's long-term fundamentals can help investors stay calm during periods of uncertainty.

Strategic Decision Making: "If you understand what’s ahead of us, the volatility becomes easier to navigate," Huhn advises. Investors should focus on the broader trends in supply and demand rather than reacting impulsively to short-term price changes.

The uranium market can be volatile, and investors need to exercise patience and strategy. Those who understand the market’s long-term trends—rising demand, geopolitical risks, and supply constraints—will be better positioned to capitalize on opportunities while minimizing the risks of short-term fluctuations.

The Role of Uranium Insider: Expert Insights for Investors

Throughout the interview, Huhn highlighted the value of the insights and research provided by Uranium Insider, a service he runs to help investors navigate the complex world of uranium investing.

In-Depth Market Analysis: Uranium Insider offers in-depth analysis, including modeling of market conditions, and tracks key market trends to give investors an edge.

Market Confidence: Huhn explains that having a deep understanding of uranium market conditions gives investors confidence when navigating volatile markets. "Our work gives our members confidence in going forward in this market," he notes.

https://www.uraniuminsider.com/

For investors seeking to make informed decisions in the uranium market, reliable sources like Uranium Insider are invaluable. Access to up-to-date research and expert analysis allows investors to stay ahead of market trends and make strategic moves based on solid data rather than reacting to market noise.

Uranium’s Future Outlook

As the world’s energy needs continue to shift toward cleaner, low-carbon sources, uranium will play a pivotal role in the global energy landscape. While supply struggles to keep up with rising demand, geopolitical risks and shifts in national nuclear policies add layers of complexity to the market. For investors, understanding these dynamics and adopting a long-term approach will be key to navigating the uranium market’s volatility and capitalizing on its potential for growth.