What if silver, a metal often overshadowed by gold, suddenly exploded in value—reaching $100 an ounce or even higher in just a matter of days? While this may seem like a wild prediction, Ed Steer, an expert in the precious metals market, believes it could be a real possibility. In a recent interview with Danny of Capital Cosm, Steer laid out several reasons why silver's price could skyrocket in a very short period. Let’s dive into the details.

The Silver Rush: A Reflection of Cracks in the System

The interview starts with Steer addressing the ongoing issues within the silver market. He explains that the demand for silver has been growing rapidly, and the manipulation of prices by large institutional players might not be sustainable much longer. Steer highlights that silver is far undervalued compared to its actual market potential, particularly in a world where demand for silver is increasing rapidly due to technological advancements, industrial use, and even military needs.

"The price management scheme that's been in place for over 50 years is starting to unravel," Steer states. He emphasizes that, once the paper markets (futures and other derivatives) that currently suppress silver prices are abandoned, we could witness an incredible surge. "You could see silver at hundreds of dollars an ounce... within a day or so." This statement underlines the idea that silver's true value is being held back by artificial forces and could surge when these constraints are lifted.

Implications for the Future

If silver prices are no longer manipulated, the floodgates could open, and the metal could find its natural price, one that reflects the actual supply and demand dynamics. Steer’s prediction aligns with growing concerns that current market dynamics are unsustainable and that a true silver price discovery is imminent. This idea has significant implications for investors who are waiting for the price to "catch up" to its true value.

How Industrial Demand and Military Needs Could Propel Silver's Value

Steer's key point is the rising industrial demand for silver, particularly from the technology and defense sectors. These industries rely heavily on silver to manufacture electronics, solar panels, and even military technology. Steer argues that countries involved in significant technological and military production—like China and the U.S.—are major consumers of silver, and as such, their demand will only continue to push prices higher.

While the exact numbers are difficult to ascertain, Steer suggests that major industrial players such as Tesla, Toyota, and even military contractors have long-term contracts to secure silver at a fixed price. However, if prices start to rise dramatically, these contracts could become less valuable, and these companies might be forced to pay the market price, which could be significantly higher than today's prices.

What This Means for the Global Market

In short, the price of silver isn’t just driven by speculative trading or investment—it's heavily influenced by real-world consumption. As industries and governments continue to consume silver at increasing rates, the strain on the already tight supply could lead to dramatic price shifts. This is especially relevant in today’s global climate, where rising tensions and an increasing demand for technology could push silver into the $100 per ounce territory.

The Growing Influence of China: A Geopolitical Factor in Silver’s Future

An intriguing aspect of the conversation revolves around China’s growing influence in the global precious metals market. Steer points out that China has been aggressively stockpiling both gold and silver for years, although the true extent of its holdings is hard to know. China’s “accumulate gold” program encourages citizens to buy gold, and Steer suggests that, much like Russia, China has likely amassed a far larger stockpile of silver than officially reported.

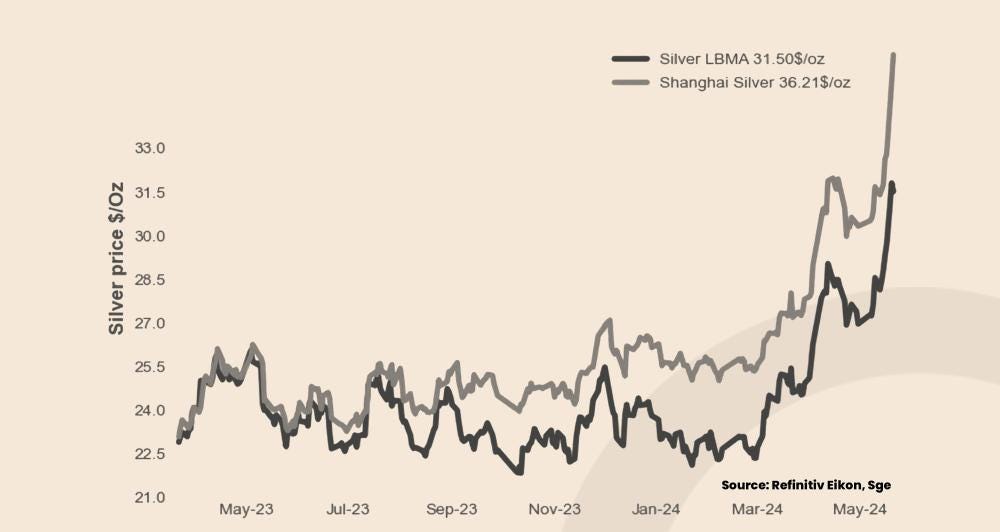

China is not only the largest silver producer but also one of the world’s biggest consumers, making it a key player in the market’s future. Steer suggests that, given China's dominance in production and consumption, the country might eventually shift the pricing of silver away from traditional Western markets (like the LBMA in London and COMEX in New York) to Shanghai.

"The price can be set anywhere," Steer says, noting that the Shanghai Exchange is becoming increasingly important. If China decides to take control of the price-setting process, the dynamics of the global silver market could shift entirely. This move would signal a monumental change in how silver is priced and traded.

Why This Could be a Game-Changer

Should China take control of the silver price-setting process, it would mark a significant geopolitical shift. Not only would this change the mechanics of the market, but it could also lead to increased volatility in silver prices. If other nations follow suit or begin hoarding silver, we could see significant supply shortages, pushing prices to unthinkable levels.

The Global Monetary Reset Is Already Underway—And It’s No Accident

This isn’t about saving the system—it’s about total control over wealth, freedom, and your future. The elites are building a financial prison where there will be no escape. If you don’t act now to protect your assets—especially in physical gold, the one asset still outside their control—you may find yourself locked in their system, with no way to get out.

The time to prepare is now, before they close the doors on your freedom.

The Possible Impact of Russia’s Silver Reserves

Steer also touches on Russia’s strategic move to build its own reserves of silver, although the specifics of these actions are not publicly disclosed. Russia, a country that is no stranger to accumulating precious metals, has been quietly stacking silver alongside gold as part of its broader efforts to diversify away from the U.S. dollar. While much of this information remains speculative, Steer has seen evidence in the past—through leaked pictures of Russian vaults—that the country has massive silver reserves hidden from the public eye.

Though Russia has not officially announced its silver stockpile, Steer’s insights hint that the country’s role in the silver market is crucial. If Russia decides to release its reserves onto the market, it could shake up the silver price structure even further.

What Does This Mean for Investors?

For investors, Russia’s silver holdings could be another catalyst for a price spike. If Russia were to reveal its reserves or release them to the market, the sheer volume could lead to a significant shift in supply-demand dynamics, potentially driving prices up. Combined with the growing influence of China, geopolitical factors could play a major role in driving silver’s value to new heights.

The Mining Sector: Underappreciated and Undervalued

A particularly striking point Steer makes is about the undervaluation of silver mining companies. Despite the rising price of silver, mining companies have not seen their stock prices reflect this growth in the commodity's value. Many silver mining stocks are priced as though silver is still languishing at $15 to $20 per ounce, when in reality, prices are much higher.

"The mining shares just suck," Steer notes, explaining that despite the increase in silver prices, mining stocks are not keeping up with the metal’s upward trajectory. This disparity could indicate an opportunity for savvy investors, as undervalued mining stocks might experience explosive growth when the market corrects itself.

Why Mining Stocks Might Be the Hidden Gem

The current undervaluation of silver mining stocks presents an opportunity for those who believe in silver’s future potential. If silver prices skyrocket, these mining companies could see their stock prices surge in response to the increased value of their output. For long-term investors, this could be a chance to capitalize on the current market inefficiency.

Final Thoughts: Are We on the Brink of a Silver Revolution?

The insights shared in this discussion are not just speculative musings—they reflect deep market movements, institutional strategies, and historical trends that cannot be ignored. If the world’s biggest financial players are accumulating gold and silver at unprecedented levels, what do they see that the average investor does not?

Could we be standing on the precipice of a radical price shift in silver—one that could materialize within days, not years? If supply chains tighten, paper markets falter, and demand continues to surge, will we see silver soar past three-digit valuations in an instant?

More importantly, if financial institutions, governments, and even military complexes are securing their share of precious metals now, why isn’t the average investor doing the same?

If China and Russia are silently amassing reserves, and if major banks are taking physical possession of gold and silver rather than merely trading derivatives, what does that signal for the future?

These are not just academic questions—they are decisions that could define financial security in the years ahead. Will you act before the tide turns, or will you be left scrambling when silver is no longer available at today’s prices?

If / when it ever breaks free from the price suppression.. it could go to any number in fiat.. but at that point there will be no retail supply available.. in my opinion