Introduction: The Reset They Won’t Announce, But You Need to See

The financial elites will never hold a press conference to announce the collapse of the global monetary system—but make no mistake, it is already happening. While politicians, central bankers, and mainstream media keep the public distracted with inflation numbers and stock market movements, the real game is being played behind closed doors.

This is the urgent warning from Taylor Kenny, a leading financial expert from ITM Trading, whose in-depth research has uncovered four undeniable signals proving that the financial system we’ve lived under for decades is being deliberately dismantled. In her analysis, she exposes how:

The current financial system was never built to last—it was built to be exploited.

Central banks are not saving the system, they are replacing it—with something far worse.

Your financial assets might not even be yours—ownership itself is a manipulated illusion.

The end goal is total control—once the new system is in place, opting out will be near impossible.

This is not speculation. These are real-world financial moves happening right now, led by the very same institutions that caused the problem in the first place. If you are not preparing for what’s coming, you are putting your financial future at risk.

Let’s break down the four signals of the global financial reset and expose the truth behind what the bankers don’t want you to know.

1. The Current Financial System Was Built to Collapse

The first thing to understand is that the current monetary system was never designed to last. It was designed for debt, control, and eventual destruction—a system where governments and central banks profit while everyday people lose everything.

The 1971 Turning Point: The Death of Sound Money

In 1971, then-President Richard Nixon took the U.S. dollar off the gold standard, severing the last link between money and real value. This move allowed:

✅ Unlimited money printing with no backing.

✅ Endless government debt spending without consequence.

✅ The rise of “paper wealth” built on financial promises, not real assets.

But here’s the problem: a system built on debt can only survive as long as people believe in it.

And right now, that belief is collapsing.

Debt Spiraling Out of Control

The United States now spends over $1 trillion per year just to cover interest payments on its national debt—and that number is only growing. Meanwhile, countries around the world are actively looking for alternatives to the U.S. dollar because they no longer trust its stability.

At the same time, the Federal Reserve and global central banks are manipulating markets to keep the illusion alive—but cracks are forming, and they know it.

The reality is this: those in power know the system is doomed, and they are already preparing for the transition.

2. The Gold Rush: Why Central Banks Are Hoarding Precious Metals

While central bankers tell the public that gold is a “barbaric relic”, they are buying it at record levels.

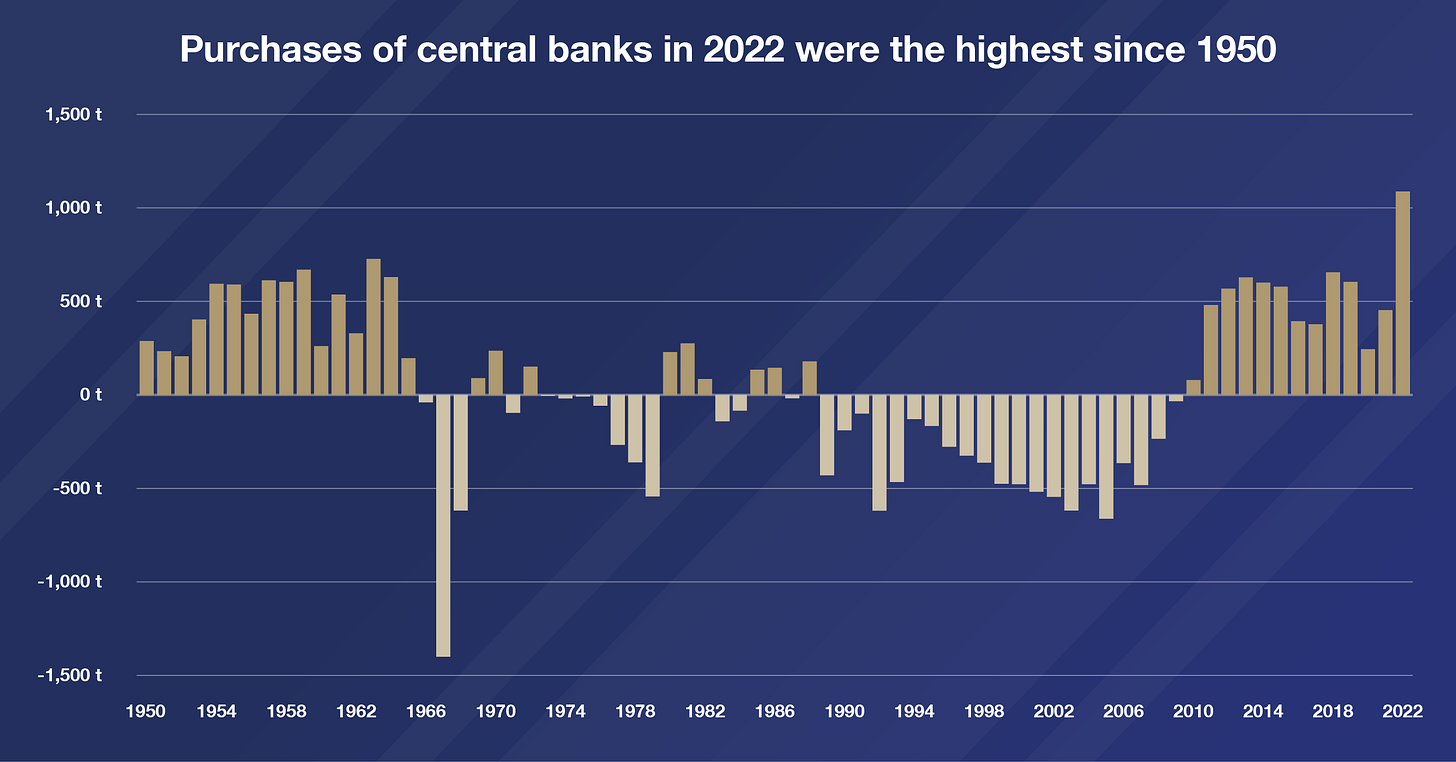

In 2022, central banks purchased more gold than any year since 1950.

China, India, Turkey, and Russia—all major economies looking to distance themselves from the Western banking system—are stockpiling gold.

Gold shortages are appearing on major exchanges, exposing that much of the “gold” people think they own only exists on paper.

This is a deliberate repositioning. While everyday investors are distracted by stocks and digital assets, the elites are moving back into hard, physical money.

Why Are They Doing This?

Because when the fiat money system collapses, gold will be the foundation of whatever comes next.

And here’s the key point: they aren’t accumulating gold because they want to return to sound money—they are doing it because they have to. The system they created is dying, and they need a backup plan that keeps them in power.

While the masses hold worthless paper and digital claims, central banks will hold the only real store of value left.

The Next 2008? How Private Equity Is Engineering a Financial Collapse

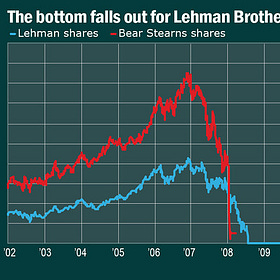

Behind the wave of business failures is a systematic wealth extraction scheme orchestrated by private equity (PE) firms. These firms are using a specialized debt strategy that not only destroys companies but also jeopardizes the financial security of millions of Americans. As Kenny outlines, this crisis has the potential to be even more devastating than the 2008 collapse.

3. The Illusion of Ownership: Your Assets Are Not Really Yours

Most people think they own their stocks, bonds, and savings. They see their brokerage accounts and bank balances and assume their wealth is secure.

But this is one of the biggest lies of the modern financial system.

How the System Has Stripped Away True Ownership

Over the past several decades, a quiet transformation has taken place. Physical ownership of assets—stocks, bonds, even real estate—has been replaced by digital records controlled by third-party intermediaries.

When you buy stocks, they are not directly owned by you—they are held by custodians and clearinghouses.

Your bank account balance is nothing more than a digital promise—the money is not physically there.

Even your retirement funds are just numbers on a screen, controlled by financial institutions with their own interests.

What does this mean? If the system collapses, you are last in line to collect. The banks, brokers, and financial elites will protect themselves first, while the public will be locked out of their own wealth.

This is not a mistake—this is by design.

4. The Endgame: A Digital Financial Prison

The financial reset that’s taking place isn’t just about dismantling the existing system—it’s about replacing it with something far more dangerous, more centralized, and more controlling. The reset isn’t being designed to give the public a "second chance" to rebuild. Instead, it’s about consolidating power in the hands of the financial elite and governments in ways most people cannot yet comprehend.

The Truth Behind Central Bank Digital Currencies (CBDCs)

The first step in this new financial order is the introduction of Central Bank Digital Currencies (CBDCs). While central banks have been hesitant to embrace fully digital currencies in the past, the collapse of the old system is forcing them to act. CBDCs will be the ultimate tool for financial control. They will replace the current fiat system, and here’s why:

Complete Control Over Transactions: Unlike physical money or even electronic bank accounts today, CBDCs will give central banks the ability to control every single transaction. Governments will have access to every single purchase you make, down to the smallest detail. They will know exactly what you’re spending on, when, and where.

Want to buy a coffee? The government will know.

Want to make a transfer to a family member? The authorities will see that too.

Even more dangerous, they could freeze your ability to make purchases altogether—whether due to political or economic reasons.

Programmable Money: What’s more concerning is that CBDCs won’t just be money—they’ll be programmable. This means governments could set terms on how, when, and where you spend your money. They could limit your ability to use funds for certain purchases, or impose expiration dates on money, forcing you to spend it within a set time frame. This isn’t just digital cash—it’s a tool for control.

For example, governments could impose restrictions on certain industries they deem “unsustainable” or “unethical.” A new digital currency system would allow them to directly control the flow of money, possibly imposing “green” spending programs, or restricting purchases that don’t align with government policies. It’s the ultimate way to exert social control.

Centralized Power: Right now, many of the global financial powers are decentralized across various banks, hedge funds, and financial institutions. But with CBDCs, all money would flow through a single, government-controlled system. It means that the state has full authority over the entire economy, from individuals to businesses, and even foreign trade. In essence, the entire financial system becomes a nationalized, government-controlled operation.

The Threat of Forced Conversion and Asset Seizure

The central banks and governments involved in this reset won’t just stop at issuing digital currencies. They are also preparing to strip away assets from individuals—a concept that seems extreme, but it’s already happening in some countries through forced conversions of currencies.

What is Forced Conversion?

Forced conversion occurs when governments or central banks decree that a certain percentage of a currency (such as physical cash) must be exchanged for the new digital currency, or that all assets need to be converted to the new system. Imagine this scenario:You’ve saved for decades in U.S. dollars, but when the reset occurs, the government mandates that your dollars are converted into the new digital system. But here’s the kicker: your dollars might be devalued, or the exchange rate may not be favorable to you. The system could essentially steal your wealth in a move disguised as a “necessary transition.”

Lopping Off Zeros and Devaluation of Assets:

As part of the reset, governments may "lop off zeros"—meaning they could devalue the currency, effectively reducing the worth of your assets overnight. This is often sold as a “restructuring” of the economy, but in reality, it’s a massive wealth transfer from individuals to governments and elites. Your savings, real estate, and other assets could lose value overnight, leaving you with a fraction of your previous wealth.Seizing Private Assets:

When financial systems collapse, one of the first things that happens is that private assets can be seized by the government. In extreme cases, this could mean that people’s bank accounts, savings, and even physical assets (like gold) are suddenly locked, frozen, or confiscated.Governments already have the legal authority to enact capital controls—measures that could restrict your ability to move money across borders or access your own funds in times of crisis. We saw similar things happen during the 2008 financial crisis, and countries like Cyprus have already tested the waters with bail-ins, where banks used depositor money to stabilize their financial systems during times of crisis.

The Risk of a Financial System with No Opt-Out

The scariest aspect of this financial reset is that it’s being designed with the express purpose of eliminating any possible opt-out. Right now, if you don’t trust the current system, you can withdraw cash, buy physical gold, and attempt to insulate yourself from the fiat system.

But once the reset happens, that option will likely be gone.

A Cashless Society: Central banks around the world are already talking about a cashless society, where physical money will be phased out entirely. This means there will be no more anonymity in transactions, and no escape from the digital grid. The centralization of financial power will be so complete that no one can hide from it—your entire wealth, identity, and economic behavior will be monitored.

The New Financial Control System: This system will be “programmable”, meaning that they can monitor, control, and freeze your assets whenever they see fit. What will happen when they decide that you are a political risk, a dissenter, or even just someone who doesn’t comply with certain regulations? They could simply block your ability to access money or make purchases. It’s not just a surveillance state—it’s a financial prison where no one has true control over their own wealth anymore.

Conclusion: The Financial Reset is Not a Mistake—it’s the Endgame

This isn’t some distant theory—it is already happening. The elites are preparing for the collapse, and once the new system is put in place, they won’t allow anyone to opt-out. CBDCs, forced asset conversions, digital control, and the end of physical money are part of a grand plan to make sure the financial system is controlled by the few at the expense of the many.

This isn’t about saving the system—it’s about total control over wealth, freedom, and your future. The elites are building a financial prison where there will be no escape. If you don’t act now to protect your assets—especially in physical gold, the one asset still outside their control—you may find yourself locked in their system, with no way to get out.

The time to prepare is now, before they close the doors on your freedom.