Dollar DOOMSDAY? Inside the Shocking Prediction That's Rocking Global Markets

Taylor Kenny's Dire Warning About the Dollar's Fate

The Accelerating Shift Away from the Dollar: An Analysis of Taylor Kenny's Warning

This article analyzes the urgent message delivered by Taylor Kenny of ITM Trading, INC., regarding a significant and ongoing shift away from the US dollar as the world's dominant reserve currency. Kenny highlights several critical indicators, including the weakening dollar index, foreign governments offloading US treasuries, and the soaring price of gold, suggesting a "slow motion collapse" of the existing global financial order. This analysis breaks down the key arguments presented, providing context and exploring the potential implications.

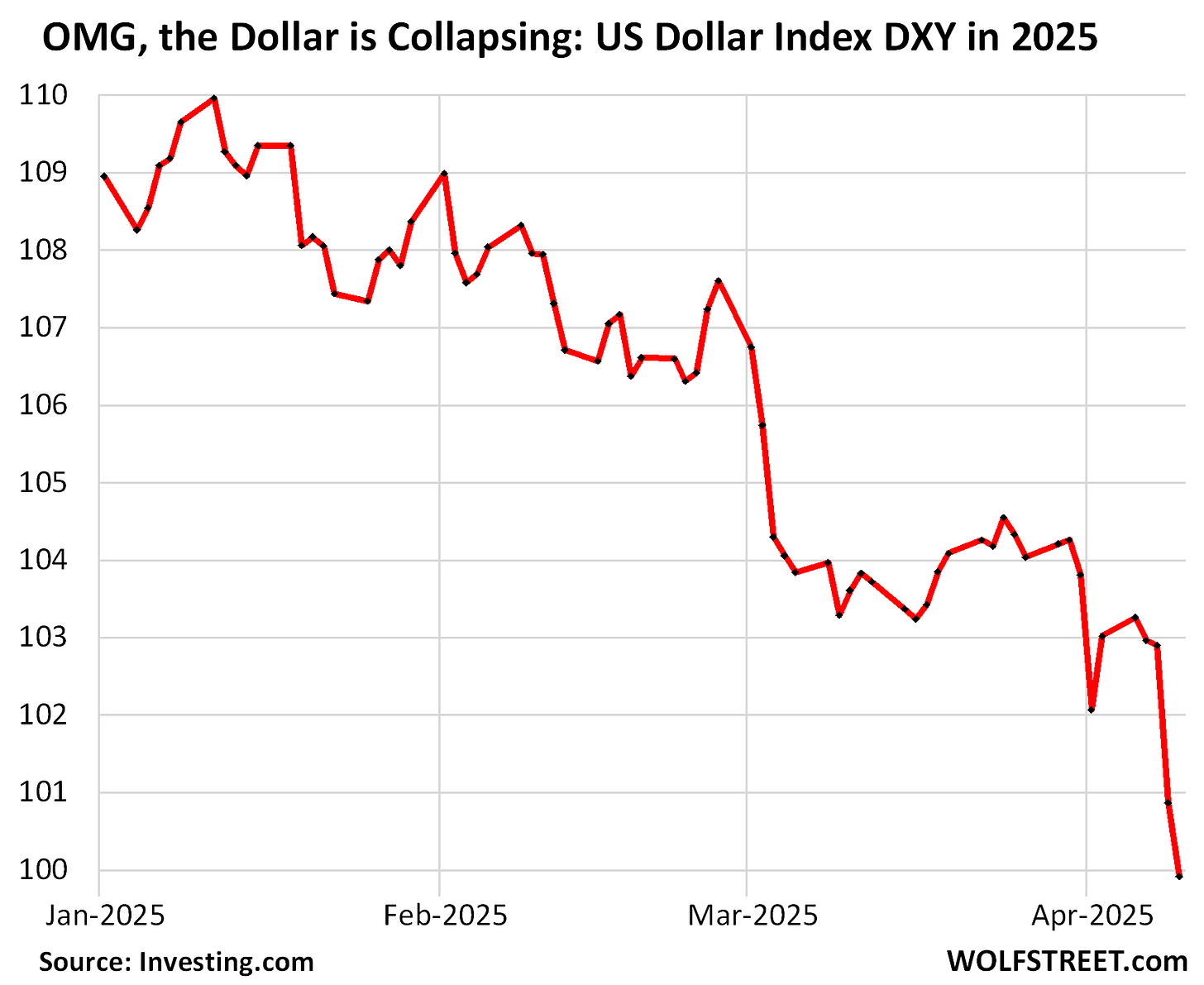

The DXY Decline: A Harbinger of Waning Global Demand

Kenny begins by drawing attention to the significant decline in the Dollar Index (DXY), stating, "over the last few weeks the dollar index or a measure of the dollar strength compared to a basket of other major foreign currencies has dropped significantly down 9% since the start of the year and almost 4% just since April 2nd. This is the dollar's worst stretch in over 20 years." She emphasizes that this is "a clear signal of waning global demand," distinguishing it from a decrease in domestic purchasing power.

The DXY's role as a benchmark for the dollar's international value makes its decline a noteworthy event. A weakening DXY typically indicates that the demand for dollars is decreasing relative to other major currencies. Kenny interprets this not merely as a fluctuation but as a fundamental shift in global sentiment towards the dollar. Her point about differentiating this from domestic purchasing power is crucial, suggesting that while the dollar might still hold its value within the US, its standing on the international stage is eroding. This erosion could have far-reaching consequences for the US's economic and geopolitical influence.

The Cracks in the Foundation: The End of Dollar Dominance?

Kenny argues that the dollar's role as the "foundation of the global financial system" for the past 80 years is now under threat. She explains, "for the last 80 years the dollar has been the global reserve currency essentially forcing other countries to settle trade in dollars hold dollars and use US westernled financial systems whether they liked it or not but today that system is breaking as nations are moving fast to escape dollar dominance." She points to the BRICS nations, led by China and Russia, as key players in creating "alternate trade options spurred on by tariffs and sanctions," advocating for a "multi-polar world order where the dollar is not at the center."

The concept of the dollar as the global reserve currency has underpinned US economic power for decades. This status allowed the US to exert significant influence over international trade and finance. Kenny's assertion that this system is "breaking" is a bold one. The rise of alternative economic blocs like BRICS and their efforts to establish independent financial systems pose a direct challenge to dollar dominance. Geopolitical tensions, as Kenny notes, historically strengthened the dollar's safe-haven appeal, but the current trend suggests a different dynamic where these tensions are instead pushing nations towards alternatives. This shift could lead to a fragmentation of the global financial landscape, reducing the dollar's centrality in international transactions and reserve holdings.

The Motivation for Departure: Beyond Economic Interests

Kenny addresses the counterargument that countries holding dollar reserves and US treasuries would not want the dollar to fail, stating, "if you're another country who feels as though the US has treated you poorly be it through tariffs sanctions or just not having a seat at the table wouldn't you be motivated to find an alternative even if you still are stuck in the system today you would be doing everything in your power to find a new path forward." She suggests that the motivation for seeking alternatives extends beyond purely economic considerations to include geopolitical grievances and a desire for greater autonomy.

Kenny's perspective highlights the interplay between economics and geopolitics. While the immediate economic implications of abandoning the dollar might be complex and potentially costly for some nations, the desire for strategic independence and a reduced reliance on the US-led financial system appears to be a significant driving force. This suggests that the erosion of dollar dominance is not solely an economic phenomenon but is also deeply rooted in shifting global power dynamics and international relations.

Rick Rule: Why This Gold Bull Market is Different (and What it Means for Silver)

“We are in a confirmed gold bull market.” He points to recent price action that has taken gold into new all-time high territory—something he considers technically and psychologically significant. According to Rule, what makes this bull market especially compelling is that it is fundamentally driven rather than sentiment-driven.

“The most important thing to me is not that gold is up, it’s why gold is up.”

Gold's Resurgence: A Flight to Tangible Value

Kenny emphasizes the significant accumulation of gold by central banks over the past decade, stating they have "bought over a billion ounces... not because it's a safe haven asset but because they understand the future monetary system that we're heading into one where trust in fiat currency specifically the dollar is broken and a new monetary system will be put in place." She connects this to recent news, such as calls to audit Fort Knox and increased demand for physical delivery, suggesting a renewed focus on gold as a foundational element of a future monetary order. She argues that this points towards "a revaluation whether officially or unofficially with gold at the center."

Gold has historically served as a store of value and a hedge against currency devaluation and economic uncertainty. Kenny's assertion that central banks are not just seeking a safe haven but preparing for a fundamental shift in the monetary system is significant. The accumulation of gold by these institutions suggests a lack of confidence in the long-term stability of fiat currencies, particularly the dollar. The idea of a gold-centric revaluation, whether formal or informal, would represent a major departure from the current fiat-based system and could have profound implications for currency valuations and global wealth distribution.

Treasury Market Turmoil: A Loss of "Safe Haven" Status

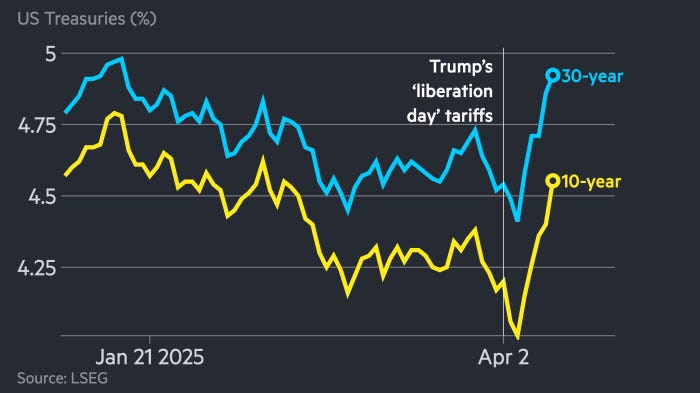

Kenny points to rising Treasury yields amidst economic uncertainty as an unusual phenomenon, stating, "over the last two weeks with yields rising something you never would expect to see during a time of economic uncertainty but treasuries are no longer considered safe assets especially during these times of uncertainty people are flocking to gold." This suggests a declining confidence in US government debt as a safe haven investment.

US Treasuries have traditionally been viewed as one of the safest assets globally. The fact that yields are rising during a period of economic uncertainty indicates a potential shift in this perception. Rising yields suggest decreased demand for these bonds, which could be driven by concerns about the US's fiscal health and the long-term value of dollar-denominated assets. Kenny's observation that investors are increasingly turning to gold instead of Treasuries as a safe haven further underscores the eroding confidence in the dollar and related assets.

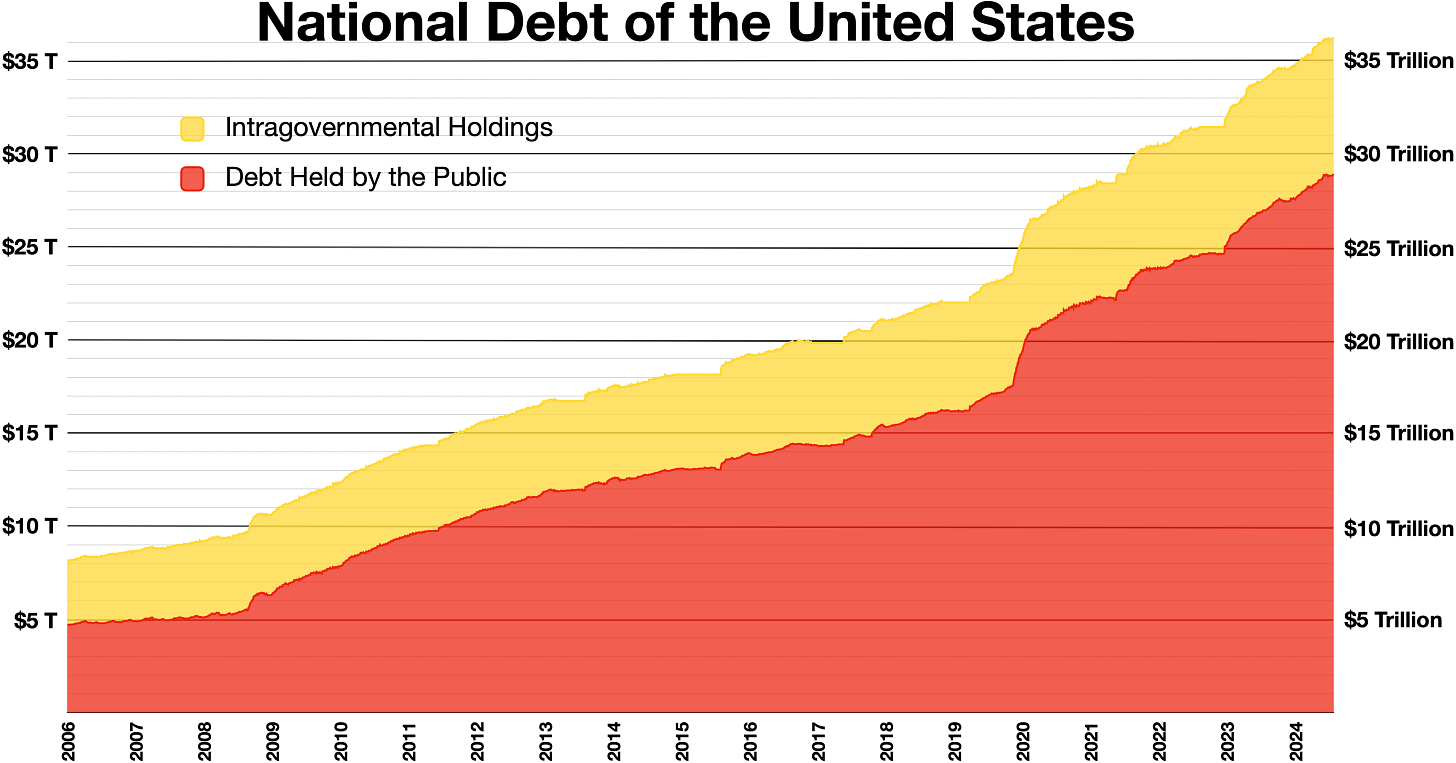

The Debt Spiral: An Unsustainable Trajectory

Kenny highlights the dangers of the US's increasing national debt, explaining the "vicious cycle" where "less demand for the debt equals higher rates higher rates equals more debt what do we do when we have more debt more debt equals more bonds issued more bonds issued flooding the market equals you need to have higher rates and so the cycle goes around and around until eventually there is nothing left to do." She warns that historically high demand for US bonds kept interest rates low, but as demand wanes, higher yields will exacerbate the debt burden, already costing over $1 trillion annually in interest payments. She suggests the Federal Reserve might be forced to "step in and buy these bonds themselves which of course means firing up the old printing press and creating money out of thin air which as we all know will lead to more inflation."

Kenny articulates a classic debt spiral scenario. As confidence in the dollar and US debt weakens, the government faces the challenge of funding its obligations at higher interest rates. This increased cost of borrowing further adds to the national debt, potentially necessitating further bond issuance and potentially leading to central bank intervention through quantitative easing. Such measures, while aimed at stabilizing the market, could lead to increased inflation, further eroding the purchasing power of the dollar and undermining global confidence.

The Boiling Frog: A Gradual Erosion of Wealth

Kenny uses the analogy of a frog in boiling water to describe the gradual decline in the dollar's value and the potential impact on the American people. She states, "the dollar today has 3 cents left of its original value meaning we've lost 97% of our purchasing power since the Federal Reserve was created and in the last 5 years we've lost 25% of what was left but this isn't slowing down the damage is only accelerating." She emphasizes the record-high debt and interest payments, warning that the "heat rising is the collapse of the dollar" and putting "your wealth at risk."

The boiling frog analogy effectively illustrates the danger of a gradual and unnoticed decline. Kenny highlights the significant loss of the dollar's purchasing power over time, emphasizing that this trend is accelerating. The massive national debt and the increasing cost of servicing that debt create a precarious economic situation that could further erode the dollar's value and impact the wealth of individuals holding dollar-denominated assets.

A Call to Action: Protecting Wealth Outside the System

Despite the dire warnings, Kenny offers a message of hope, stating, "the good news here though is that the frog always had a choice you can still escape the system you can still protect your wealth outside of the failing dollar but you have to act before it's too late." She advocates for physical gold and silver as a means of wealth protection, emphasizing their tangible nature and historical role as stores of value that "cannot be inflated away." She urges viewers to take action and explore options for safeguarding their assets outside the traditional dollar-based financial system.

Kenny's recommendation of physical gold and silver aligns with the historical role of precious metals as hedges against currency devaluation and economic instability. In a scenario where confidence in fiat currencies, particularly the dollar, is waning, tangible assets like gold and silver can offer a store of value that is independent of government policies and monetary printing. Her call to action underscores the urgency she perceives in the current situation, suggesting that proactive measures are necessary to mitigate the potential risks associated with a declining dollar.

In conclusion, Taylor Kenny presents a compelling case for a significant and accelerating shift away from the US dollar as the dominant global currency. She cites the weakening DXY, the offloading of US treasuries, the surge in gold prices, and the unsustainable trajectory of US debt as critical warning signs. Her analysis suggests a confluence of economic and geopolitical factors driving this change, with nations seeking alternatives to the dollar-centric system. While the implications of such a shift are complex and far-reaching, Kenny's message underscores the potential risks for those holding dollar-denominated assets and advocates for proactive measures, particularly through tangible assets like gold and silver, to protect wealth in an uncertain financial future.