Trump's Economic Plan Under Fire: Casey & Smith's Deep Dive on Tariffs, China, and the Case for Gold.

In a compelling exchange, financial expert Matt Smith explores the unconventional economic playbook of the administration with legendary contrarian investor Doug Casey. Their dialogue moves beyond surface-level tariffs and trade disputes to examine the potential for a fundamental shift in global economic and geopolitical power. This article distills their critical analysis—from questioning the national security rationale behind economic policies to forecasting a mining boom and preparing for potential global conflict—while retaining the essence of their thought-provoking conversation.

The National Security Gambit: Unmasking Protectionist Intentions?

The conversation begins with Matt Smith questioning the rationale behind Trump's tariffs, particularly the invocation of national security. He sarcastically notes measures like steel tariffs, stating, “They are calling it a national security emergency... It’s not economic fascism when you do it under national security.” Doug Casey immediately echoes this skepticism, asserting bluntly, “It’s insane to call steel imports a national security threat. It’s completely dishonest.”

But let's cut through the rhetoric, shall we? This invocation of "national security" feels less like genuine concern for the nation's defense and more like a convenient cloak for old-fashioned protectionism. Sure, proponents will trot out the usual arguments about safeguarding domestic industries, but at what cost? Are we so easily swayed by this fear-mongering that we ignore the very real risk of eroding trust in the concept of genuine national security? If everything is a national security emergency, then nothing truly is. And the long-term consequences for sound economic principles? They seem to be taking a backseat to this politically expedient narrative.

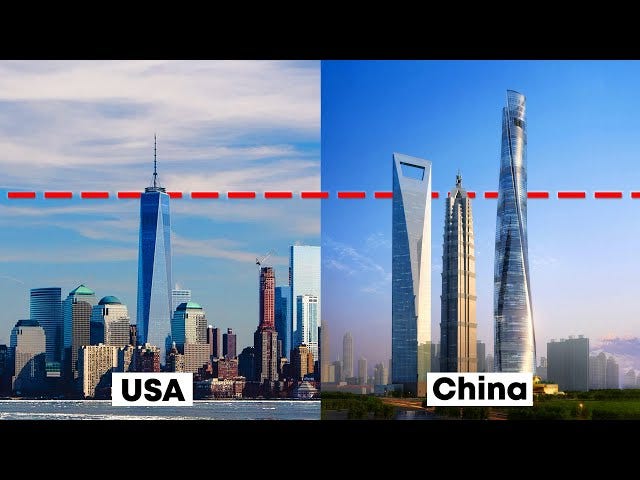

Echoes of State Control: America Mirroring China's Economic Model?

A significant point of discussion is Trump’s push for large-scale subsidies, which Matt highlights by quoting, “We’ll give billions and billions—tens, hundreds of billions of dollars to industries that I think are important here in the U.S.” Doug Casey responds sharply to this approach, stating, “This is what you call full economic fascism—cooperation of state with corporations. This is going down a bad road,” and further adding, “It sure seems to me like they want to copy the China model.”

Now, isn't this a chilling thought? This eagerness to shower favored industries with taxpayer billions smacks of the very state-controlled economies that the free world has historically critiqued. Casey's "economic fascism" label might sound extreme, but doesn't it capture the essence of blurring the lines between state and corporate power? Are we truly on a path to emulate the China model, sacrificing free-market dynamism for a centrally planned, nationalistic agenda? The implications for innovation and long-term economic health are deeply troubling.

Navigating a Precarious Peak: Casey's Warning on Overvalued Markets

Casey’s assessment of the stock and bond markets paints a picture of significant risk. He observes, “The Dow Jones is up... S&P is up half a percent... Gold is up over $100 an ounce also,” but then cautions, “The stock market is at one of its most overpriced times in history—like 1929 or 2000... Do you really want to be in stocks? The answer is no.” On bonds, he warns, “Do you want to be in the bond market when the dollar is going down the toilet? No.”

Think about that for a moment. Casey, a seasoned investor with a knack for spotting bubbles, is drawing parallels to the catastrophic peaks of 1929 and 2000. Are we so confident in the current market exuberance that we dismiss these historical red flags? And his point about the dollar's decline and the bond market? It's a stark reminder that even seemingly safe havens might be treacherous in this environment. This isn't just about market fluctuations; it's about the potential erosion of wealth itself.

Trump’s Tariff Strategy: How Market Chaos is Unfolding

The legacy of Trump's tariffs is still unfolding. As Lighthizer advocates for “strategic decoupling” and calls for a more cautious approach, one has to ask: Can the U.S. achieve self-reliance in the face of global economic interdependence? What will the next phase of the U.S.-China economic rivalry look like, and how will the world respond? These questions remain as pressing as ever, inviting further scrutiny and reflection on how international trade policies shape the global order.

Unlocking Intrinsic Value: Gold as the Ultimate Refuge in Uncertain Times

For Casey, gold represents a fundamental store of value, uniquely positioned as an asset free from the liabilities of governments or corporations. He asks rhetorically, “Where are you going to put your money?” and answers, “Gold is the only financial asset that’s not someone else’s liability.” He emphasizes, “We’re looking at financial chaos… I think it’s going a lot higher.” The rising interest in silver, which he notes is up nearly 3%, further supports this view.

In a world where trust in institutions and fiat currencies seems increasingly fragile, Casey's unwavering belief in gold's intrinsic value carries a certain weight. Unlike paper assets that can be printed into oblivion or whose value can evaporate with a market crash, gold has stood the test of time. Is he right that we're heading for "financial chaos"? And if so, are we adequately positioned in assets that can weather such a storm?

Resource Nationalism Trumps Ideology: The Coming Mining Renaissance

Casey's prediction of a mining boom is rooted in the growing geopolitical imperative for nations to secure their own supply chains for critical resources, particularly to reduce reliance on China. He predicts, “There will be a mining boom... They gotta get it away from China, and China has a stranglehold.” He argues that the influence of ESG (Environmental, Social, Governance) investing, which has often deterred investment in mining, is likely to wane as resource security becomes a higher priority, stating, “Those are being washed away.”

Consider the implications here. Could the green agenda and socially conscious investing take a backseat to the raw necessity of securing vital resources? Casey seems to think so. As the West grapples with China's dominance in critical minerals, the demand for domestically sourced materials could indeed skyrocket, potentially breathing new life into sectors that have been out of favor for years. It's a stark reminder that geopolitical realities can often trump idealistic investment strategies.

The Perilous Path of Economic Conflict: A 21st Century Powder Keg?

The comparison to the lead-up to World War II underscores the grave concerns about the potential for economic conflict to escalate into military confrontation. Matt Smith draws parallels to pre-World War II tensions, stating, “If we’re trying to cut off oil from China... this just reminds me of World War II. Isn’t this how we went to war with Japan?” Doug Casey responds bluntly, “Absolutely... That’s one reason I feel physically safer down here [in Uruguay] than in Virginia. You’re in the blast zone.”

Let that sink in. Casey, a seasoned observer of global trends, feels compelled to physically relocate due to the perceived risk of a major conflict. Smith's historical analogy to the events leading up to Pearl Harbor is chillingly pertinent. Are we sleepwalking into a similar scenario where economic pressures and resource competition ignite a far more devastating conflict? The stakes, as they suggest, could be far higher than mere trade imbalances.

Bracing for the Tempest: Casey's Urgent Call for Personal Financial Fortification

Casey's concluding advice is a direct and urgent call for individuals to take proactive steps to protect themselves from potential economic and geopolitical turmoil. He advises, “If anybody listening doesn’t have a good pile... of gold coins and a bunch of silver coins... it’s time to rig for heavy running,” and continues, “Get out of leverage… Get a second job… This is a time to gird things up while the sun is shining.”

This isn't just abstract economic theory; it's a practical, almost visceral warning. Casey's imagery of "rigging for heavy running" suggests an impending storm that requires immediate preparation. Are we heeding this advice? Are we taking concrete steps to reduce our vulnerabilities in a world that seems increasingly unpredictable?

Beyond the Echo Chamber: Embracing Critical Dialogue in a Shifting World

The final remarks emphasize the importance of independent thought and open discussion in navigating an increasingly complex and uncertain world. Matt Smith encourages the audience, “If you disagree with what we’re saying, explain why... Don’t just say we’re idiots,” and Doug Casey echoes this sentiment, “We’re trying to understand a world that is changing so fast... and the people who could tell us what’s going on do not.”

In an age of information overload and often biased narratives, their call for critical thinking and open dialogue is more important than ever. Are we willing to challenge the prevailing wisdom and engage in uncomfortable conversations to understand the true nature of the changes unfolding around us?

A Strategy of Survival in a New Economic Paradigm As Doug Casey and Matt Smith delve into the shifting tides of economic and geopolitical power, they leave us with unsettling questions about the future. Are we truly witnessing the rise of economic nationalism, cloaked under the guise of national security? What will be the long-term effects of a U.S. economic strategy that mirrors the corporate-state collaboration seen in China? And with markets at their most overpriced in history, is it time for us to reevaluate the assets we trust to secure our financial futures?

Casey’s call for vigilance—his urgent reminder to secure gold, reduce leverage, and prepare for chaos—forces us to reconsider the stability of the systems we’ve relied on for decades. With global tensions rising and the world inching closer to what many fear could be a conflict of catastrophic proportions, the question remains: How can we brace for an uncertain future, and more importantly, how can we protect ourselves from the storm that may be on the horizon?

In a world where the narrative seems increasingly dictated by governments and corporations, do we risk losing our ability to think critically and act independently? Are we prepared to face the economic shocks that could come with policies driven more by power than by principle?

These are the questions that Doug Casey and Matt Smith's conversation raises—and they are questions that demand urgent answers from all of us. As we look ahead to an era defined by geopolitical upheaval, rising resource nationalism, and volatile financial markets, the key to survival may not lie in following the crowd, but in making decisions that protect our wealth, our freedom, and our future.

What steps will you take in response to these warning signs? The clock is ticking, and the world around us is changing—fast.