At the 2025 BMO Global Metals, Mining & Critical Minerals Conference, Kitco Senior Mining Editor Paul Harris sat down with Keith Neumeyer, President and CEO of First Majestic Silver, to discuss the company’s recent acquisition of Gatos Silver, the evolving dynamics of the silver market, institutional investment sentiment, and the future outlook for the company and the industry.

First Majestic Silver’s Acquisition of Gatos Silver: A Game-Changer

One of the major highlights of the discussion was First Majestic Silver’s recent acquisition of Gatos Silver, a deal worth $970 million that closed in January 2025. This acquisition has added the Los Gatos mine to First Majestic’s portfolio, a significant asset producing approximately 13–14 million ounces of silver equivalent annually. Through the deal, First Majestic secured a 70% stake, adding around 9 million ounces of silver equivalent to its books.

"We started talking to Gatos at this conference last year... there were several bidders trying to buy that company. It's a very unique business, only been in production for a couple of years, very modern mill, producing 13 to 14 million ounces of silver equivalent."

Increased Production: The acquisition boosts First Majestic’s annual silver equivalent production from 21 million ounces to approximately 32 million ounces, making it a more dominant player in the sector.

Diversification: The mine’s metals composition includes 53% silver and 35% gold, with the rest in lead and zinc, reducing reliance on a single metal.

Competitive Landscape: The deal comes at a time when consolidation is reshaping the industry. Neumeyer highlighted that with Coeur Mining acquiring SilverCrest Metals, the number of significant silver companies is shrinking, making high-quality silver mines even rarer.

Silver Market Dynamics: Supply, Demand, and Price Outlook

The silver market is undergoing major structural shifts. Despite stable mine supply, demand is rising due to technological applications, AI, data centers, nuclear power, and military uses.

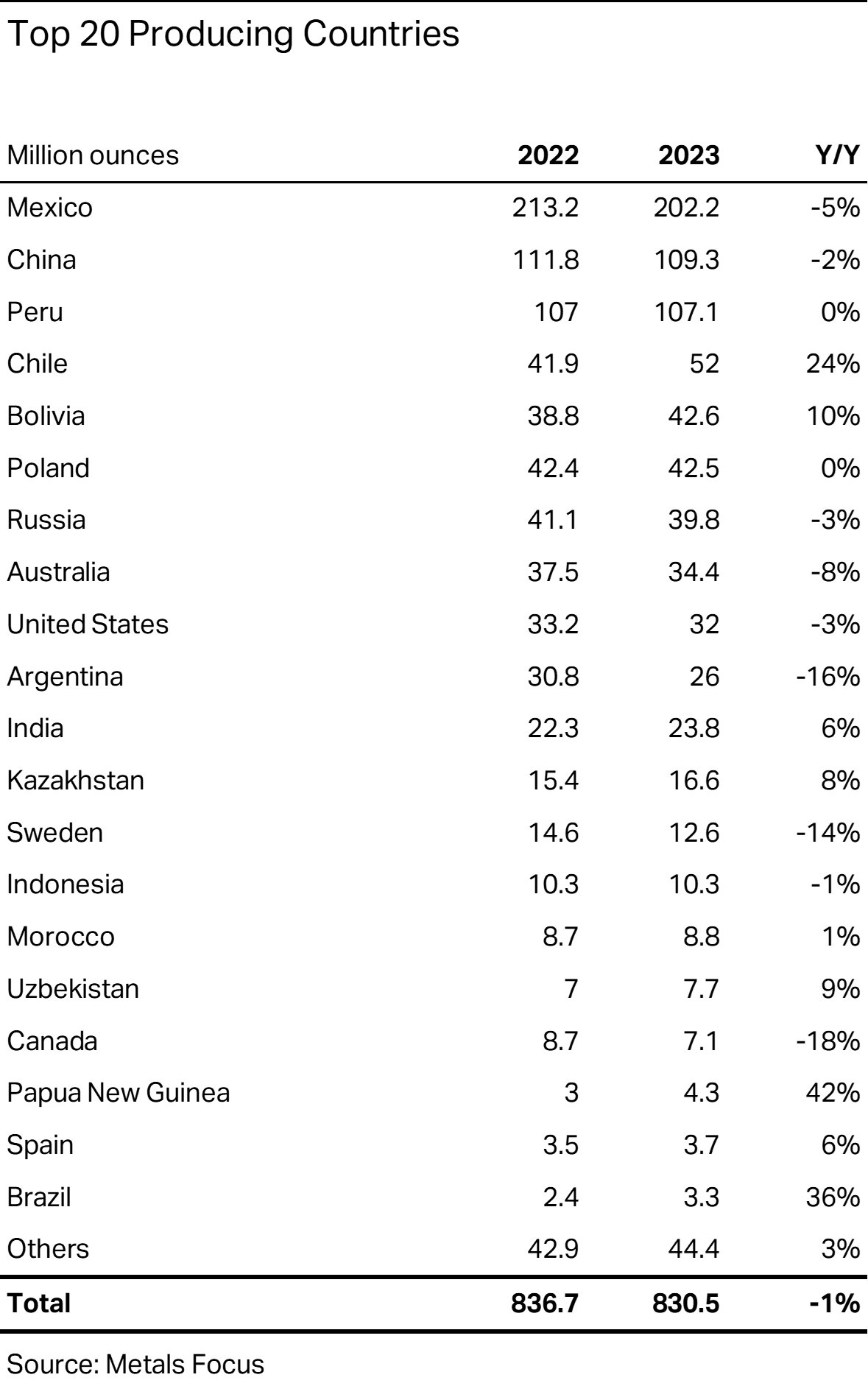

Supply Constraints: Silver mine supply has remained flat at 830–850 million ounces per year for the past decade, with few new large-scale silver mines expected to come online soon.

Rising Demand: Silver consumption is approaching 1.4 billion ounces per year, driven by its role in electronics, AI, clean energy, and defense industries.

Price Trends: Silver prices have surged past $34 per ounce, levels not seen since the early 2010s, and Neumeyer remains bullish on long-term silver prices.

The silver supply-demand imbalance suggests higher future prices, potentially returning to the $50 per ounce range last seen in 2011.

If institutional investment increases, silver could break past historical price ceilings.

Paper Silver vs. Physical Silver: Neumeyer is critical of how paper silver trading distorts real market prices, warning that one day a major bank might be unable to fulfill a large silver order, triggering a price surge.

In ancient civilizations, the gold-to-silver ratio was often fixed by decree. For example, in Egypt, around 3,000 BC, the ratio was set at approximately 1:2. This reflected the relative abundance and difficulty of extracting gold compared to silver in that era. Moving into the Roman Empire, the ratio averaged closer to 1:12, a balance determined by the mining and economic systems of the time.

First Majestic’s Refining & Minting Strategy

One unique aspect of First Majestic’s business strategy is its refining and minting operations in Las Vegas, Nevada. The company has been producing unique silver bars and coins, including the 1776 Bar and Lunar Series.

"We had a record quarter, selling a lot of silver... We’re producing unique products like the 1776 Bar and the Lunar Series. The goal is to get 10% of our production through the mint in 2025."

By selling directly to investors, First Majestic cuts out middlemen, securing higher premiums on its silver.

The refining business also removes silver from the broader paper silver market, potentially reducing supply available for manipulation.

Institutional Investment Sentiment: Why Aren’t Investors Jumping In?

Despite record-high gold and silver prices, institutional investment in mining stocks remains low. Neumeyer noted that while First Majestic reported a record free cash flow of $68 million in Q4 2024, its stock price saw only minor gains.

Market Uncertainty: Many institutions are waiting for a stock market correction before investing in mining stocks.

Comparison to 2001–2002: Neumeyer compared today’s situation to the early 2000s tech crash, when institutional money flooded into mining as a safe haven.

If a major market correction occurs, gold and silver stocks could surge, mirroring the bull run from 2002 to 2011.

Retail investors might have an early-mover advantage before institutions re-enter.

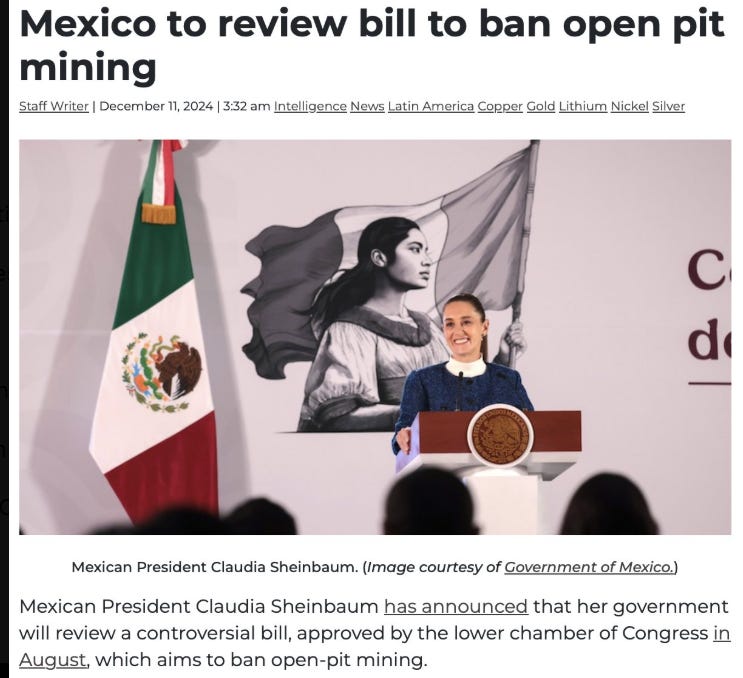

Mexico’s New Government and Its Impact on Mining

With a new administration under President Claudia Sheinbaum, Mexico’s stance on mining appears to be more favorable than under the previous government.

Mining Permits Are Being Issued Again: Neumeyer confirmed that First Majestic has received new permits, signaling a shift in policy.

More Stability for Foreign Investment: The government’s toned-down rhetoric on mining provides a more business-friendly environment.

The restoration of mining permits is crucial for future expansion in Mexico, where First Majestic has significant assets.

A six-year presidential term provides stability for long-term investments.

Future Goals: Expansion, Share Buybacks, and a 50 Million Ounce Vision

Looking ahead, First Majestic plans to strengthen its financial position and position itself for future acquisitions.

Share Buybacks: The company is actively buying back stock, signaling management confidence in its valuation.

Cash Hoarding: First Majestic aims to end 2025 with a record-high treasury, preparing for future deals.

Long-Term Growth: Neumeyer’s goal is to grow First Majestic into a 50 million-ounce silver equivalent producer.

The cash hoarding strategy provides financial flexibility for potential future acquisitions.

Growing production beyond 32 million ounces would solidify First Majestic’s position as a top-tier silver producer.

A Transformational Year for First Majestic Silver

The acquisition of Gatos Silver, tightening silver supply, institutional hesitation, and Mexico’s policy shift all point to a pivotal year for First Majestic Silver. Neumeyer remains bullish on silver’s long-term potential, emphasizing higher prices, direct sales strategies, and future acquisitions as key drivers for growth.

As the silver market continues to evolve, First Majestic’s strategic positioning and strong financials suggest it is well-prepared to capitalize on upcoming opportunities. Investors should watch closely as the silver sector navigates a shifting landscape.

Support My Work – Help Secure a Stronger Future

If you enjoy reading Financial Anarchy and find value in the content I produce, I would greatly appreciate your support through a paid subscription or donation. While all my work is available for free, your support helps me maintain and grow this platform while providing for my family.

Your contributions allow me to continue creating high-quality, insightful material on finance, economics, and global events—without relying on outside funding. This means I can remain independent and focused on delivering the content that matters to you.

Becoming a paid supporter, even at a small level, helps improve my financial stability, allowing me to dedicate more time and resources to producing content you love. Every donation makes a difference, and your support truly means the world to me and my family.

Thank you for being part of Financial Anarchy. Together, we can continue to grow this community and keep the content coming!